Digital payment platform Paymentus (NYSE: PAY) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 34.2% year on year to $310.7 million. On top of that, next quarter’s revenue guidance ($309.5 million at the midpoint) was surprisingly good and 5.8% above what analysts were expecting. Its non-GAAP profit of $0.17 per share was 14.6% above analysts’ consensus estimates.

Is now the time to buy Paymentus? Find out by accessing our full research report, it’s free for active Edge members.

Paymentus (PAY) Q3 CY2025 Highlights:

“Paymentus continued to execute in the third quarter with double-digit year-over-year growth in revenue, contribution profit and adjusted EBITDA, of 34.2%, 22.8% and 45.9%, respectively, driven by strong new implementations and customer demand. Our exceptional bookings year-to-date, along with our considerable backlog, provide us great visibility for the remainder of 2025 and 2026,” said Dushyant Sharma, Founder and CEO.

Company Overview

Founded in 2004 to simplify the complex world of bill payments, Paymentus (NYSE: PAY) provides a cloud-based platform that helps utilities, municipalities, and service providers automate billing and payment processes.

Revenue Growth

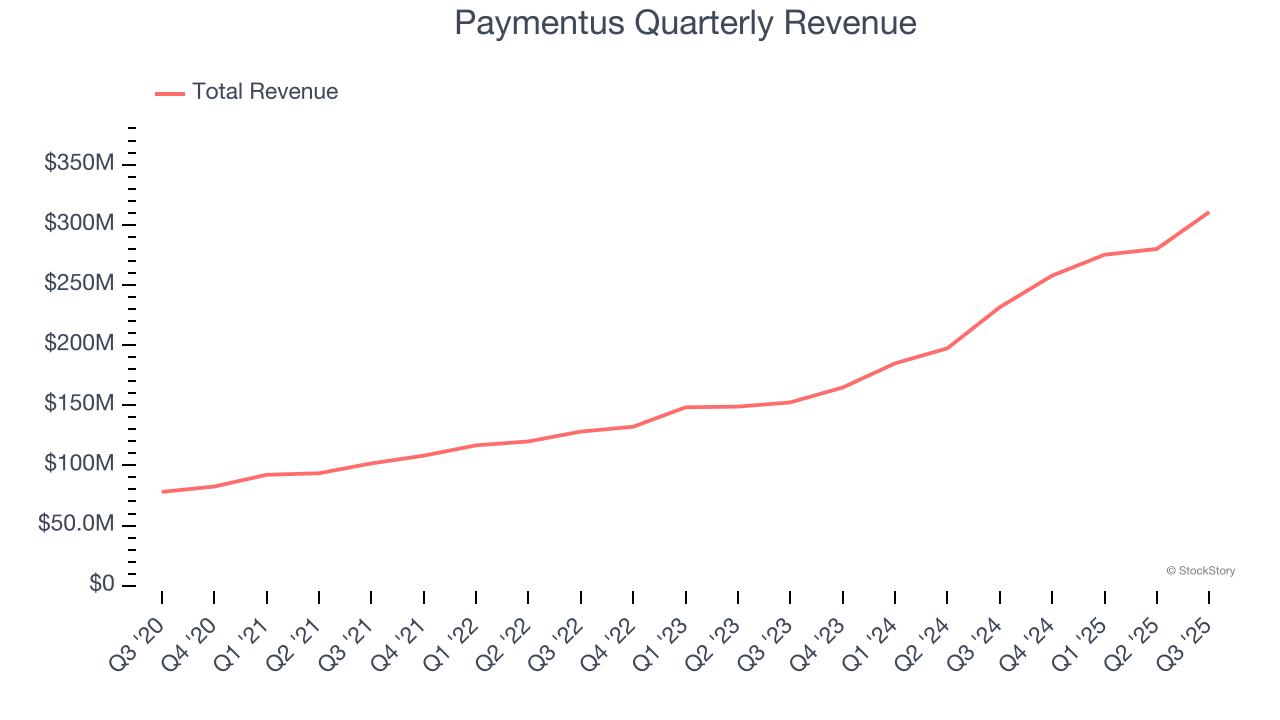

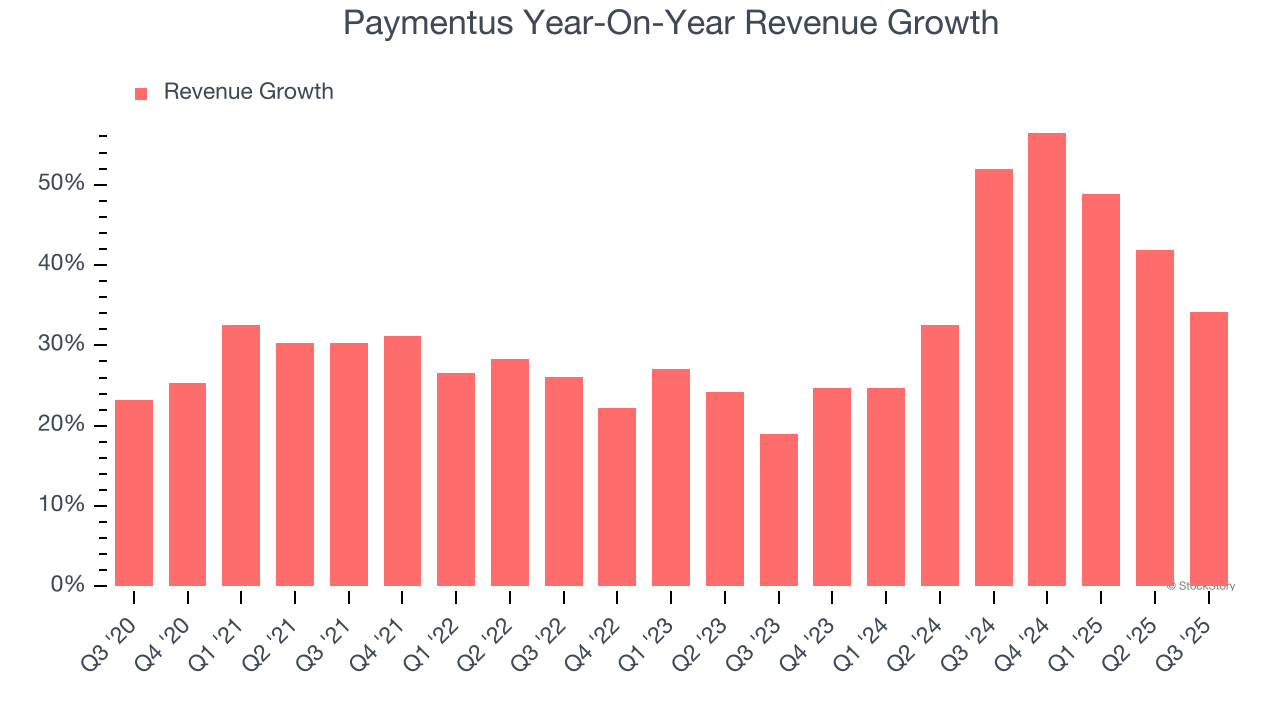

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Paymentus grew its revenue at an incredible 31.6% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Paymentus’s annualized revenue growth of 39% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Paymentus reported wonderful year-on-year revenue growth of 34.2%, and its $310.7 million of revenue exceeded Wall Street’s estimates by 10.7%. Company management is currently guiding for a 20% year-on-year increase in sales next quarter.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Paymentus’s Q3 Results

We were impressed by how significantly Paymentus blew past analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 11.3% to $31.79 immediately following the results.

Paymentus may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.