Ulta has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.3%. The stock now trades at $509.41, marking a 24.2% gain. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy ULTA? Find out in our full research report, it’s free for active Edge members.

Why Does Ulta Spark Debate?

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ: ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Two Positive Attributes:

1. Store Growth Signals an Offensive Strategy

A retailer’s store count often determines how much revenue it can generate.

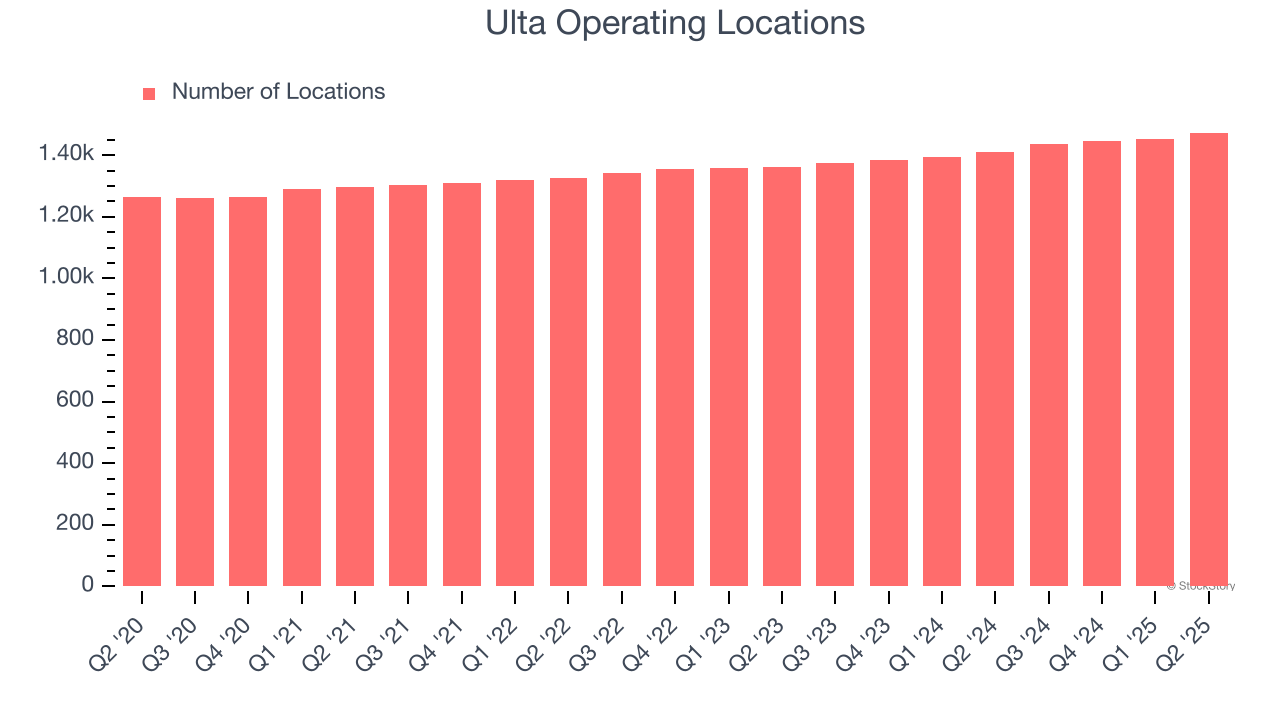

Ulta sported 1,473 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 3.5% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Ulta’s five-year average ROIC was 32.1%, placing it among the best consumer retail companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

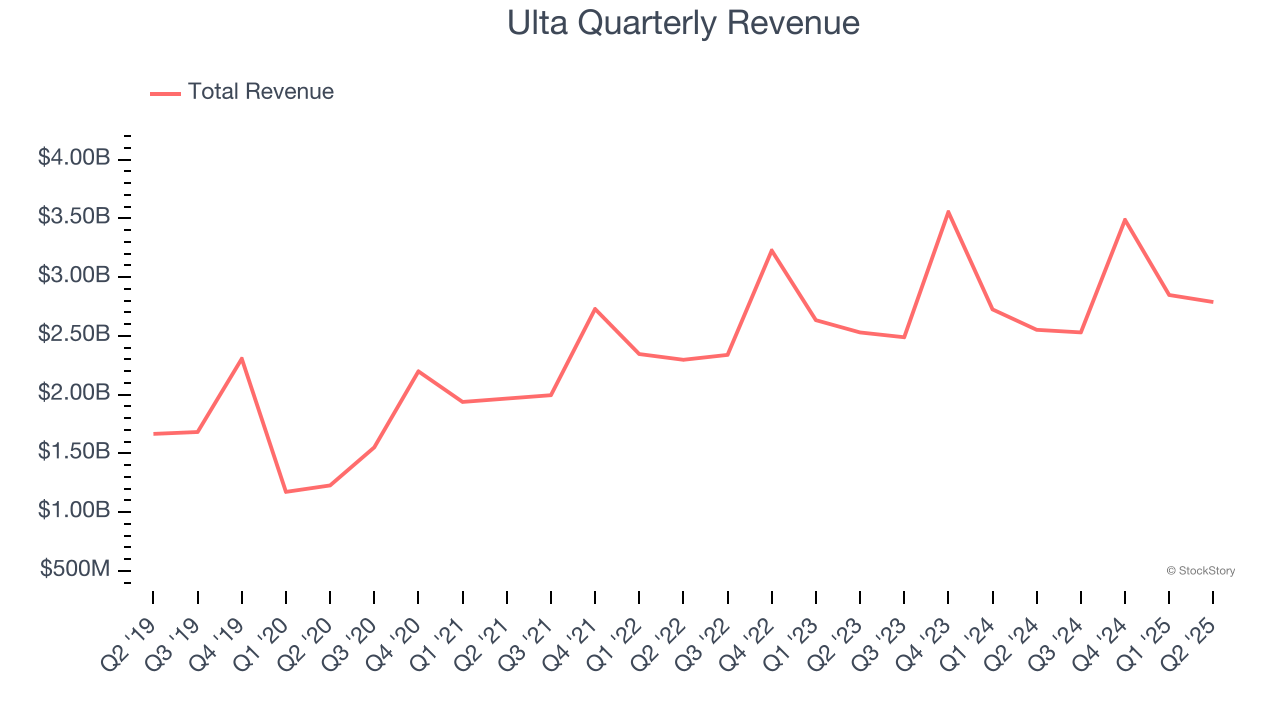

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last six years, Ulta grew its sales at a mediocre 8.6% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Ulta.

Final Judgment

Ulta’s positive characteristics outweigh the negatives, and with its shares outperforming the market lately, the stock trades at 20.7× forward P/E (or $509.41 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Ulta

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.