As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the leisure facilities industry, including Topgolf Callaway (NYSE: MODG) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.4% below.

While some leisure facilities stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.4% since the latest earnings results.

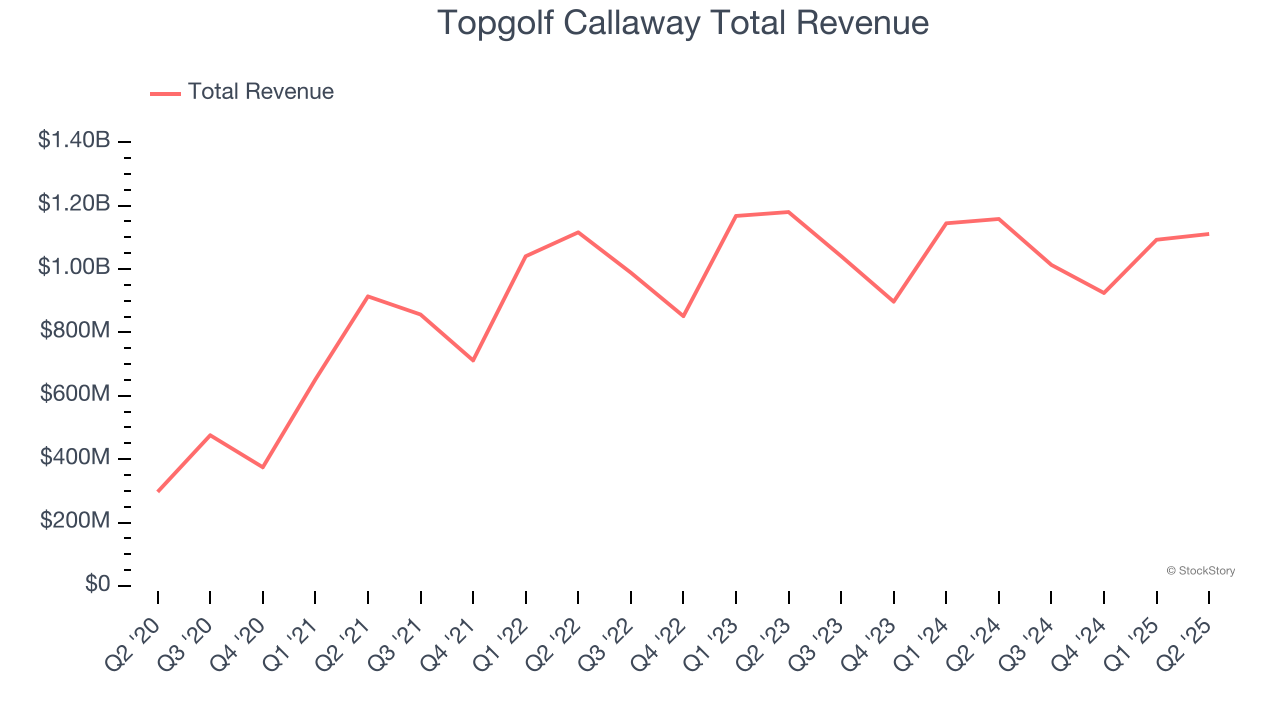

Topgolf Callaway (NYSE: MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $1.11 billion, down 4.1% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS and EBITDA estimates.

"We are pleased with our second quarter financial results as we met or beat expectations in all segments of our ongoing business and our consolidated revenue and Adjusted EBITDA surpassed our expectations going into the quarter," stated Chip Brewer, CEO of Topgolf Callaway Brands.

Topgolf Callaway delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 2.3% since reporting and currently trades at $9.

Is now the time to buy Topgolf Callaway? Access our full analysis of the earnings results here, it’s free for active Edge members.

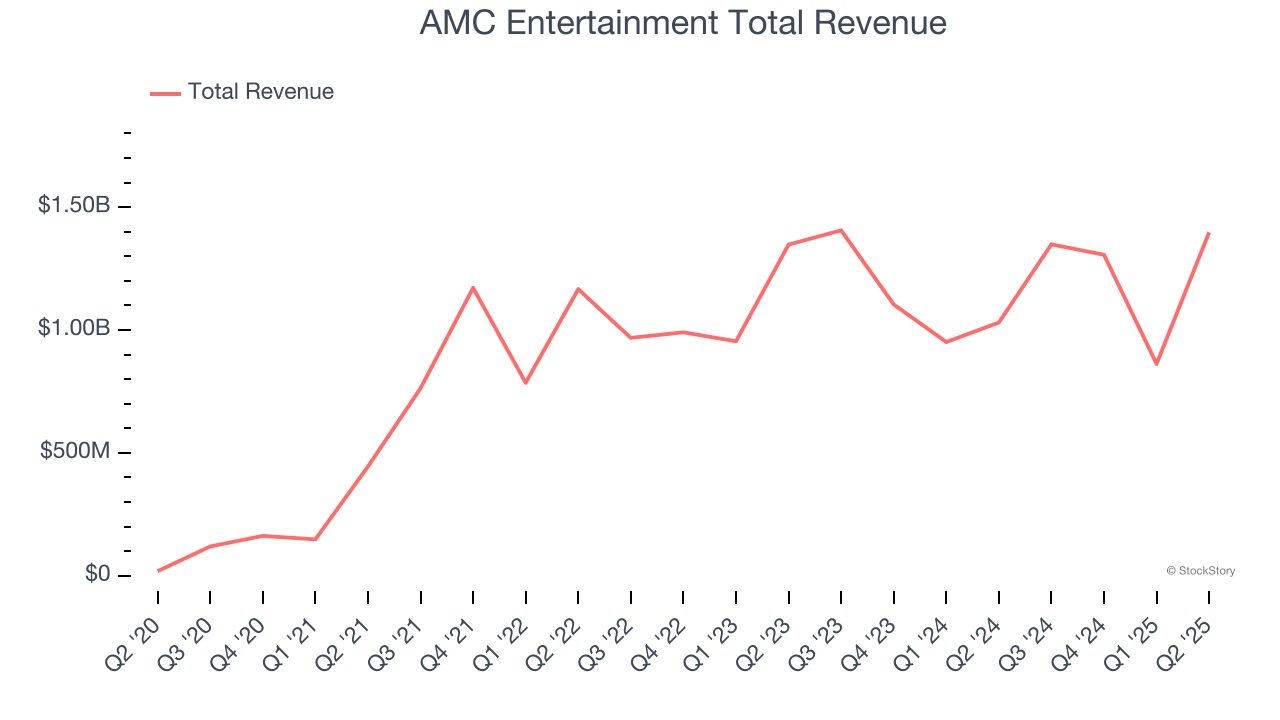

Best Q2: AMC Entertainment (NYSE: AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE: AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.40 billion, up 35.6% year on year, outperforming analysts’ expectations by 3.1%. The business had a stunning quarter with a beat of analysts’ EPS and adjusted operating income estimates.

AMC Entertainment delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.9% since reporting. It currently trades at $2.85.

Is now the time to buy AMC Entertainment? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Dave & Buster's (NASDAQ: PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ: PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $557.4 million, flat year on year, falling short of analysts’ expectations by 0.9%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 26.8% since the results and currently trades at $17.73.

Read our full analysis of Dave & Buster’s results here.

Live Nation (NYSE: LYV)

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $7.01 billion, up 16.3% year on year. This result topped analysts’ expectations by 3.4%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EBITDA estimates.

Live Nation pulled off the biggest analyst estimates beat among its peers. The stock is up 1.6% since reporting and currently trades at $151.

Read our full, actionable report on Live Nation here, it’s free for active Edge members.

Planet Fitness (NYSE: PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $340.9 million, up 13.3% year on year. This number beat analysts’ expectations by 2.5%. It was a very strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ same-store sales estimates.

The stock is down 12.3% since reporting and currently trades at $96.

Read our full, actionable report on Planet Fitness here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.