Business advisory firm FTI Consulting (NYSE: FCN) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3.3% year on year to $956.2 million. The company expects the full year’s revenue to be around $3.71 billion, close to analysts’ estimates. Its GAAP profit of $2.60 per share was 39% above analysts’ consensus estimates.

Is now the time to buy FTI Consulting? Find out by accessing our full research report, it’s free for active Edge members.

FTI Consulting (FCN) Q3 CY2025 Highlights:

- Revenue: $956.2 million vs analyst estimates of $945.2 million (3.3% year-on-year growth, 1.2% beat)

- EPS (GAAP): $2.60 vs analyst estimates of $1.87 (39% beat)

- Adjusted EBITDA: $130.6 million vs analyst estimates of $101.2 million (13.7% margin, 29% beat)

- The company reconfirmed its revenue guidance for the full year of $3.71 billion at the midpoint

- Operating Margin: 12.3%, up from 9.8% in the same quarter last year

- Free Cash Flow Margin: 19.6%, down from 22.9% in the same quarter last year

- Market Capitalization: $4.95 billion

Steven H. Gunby, CEO and Chairman of FTI Consulting, commented, “Notwithstanding major headwinds in a couple of our businesses, we delivered, yet again, record revenues and earnings this quarter. These tremendous results, to me, confirm once again the power of our team and the strength of our continued commitment to invest behind great professionals who help clients navigate their most significant opportunities and challenges.”

Company Overview

With a team of experts deployed across 30+ countries to tackle complex business challenges, FTI Consulting (NYSE: FCN) is a global business advisory firm that helps organizations manage change, mitigate risk, and resolve disputes across financial, legal, operational, and regulatory matters.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.69 billion in revenue over the past 12 months, FTI Consulting is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

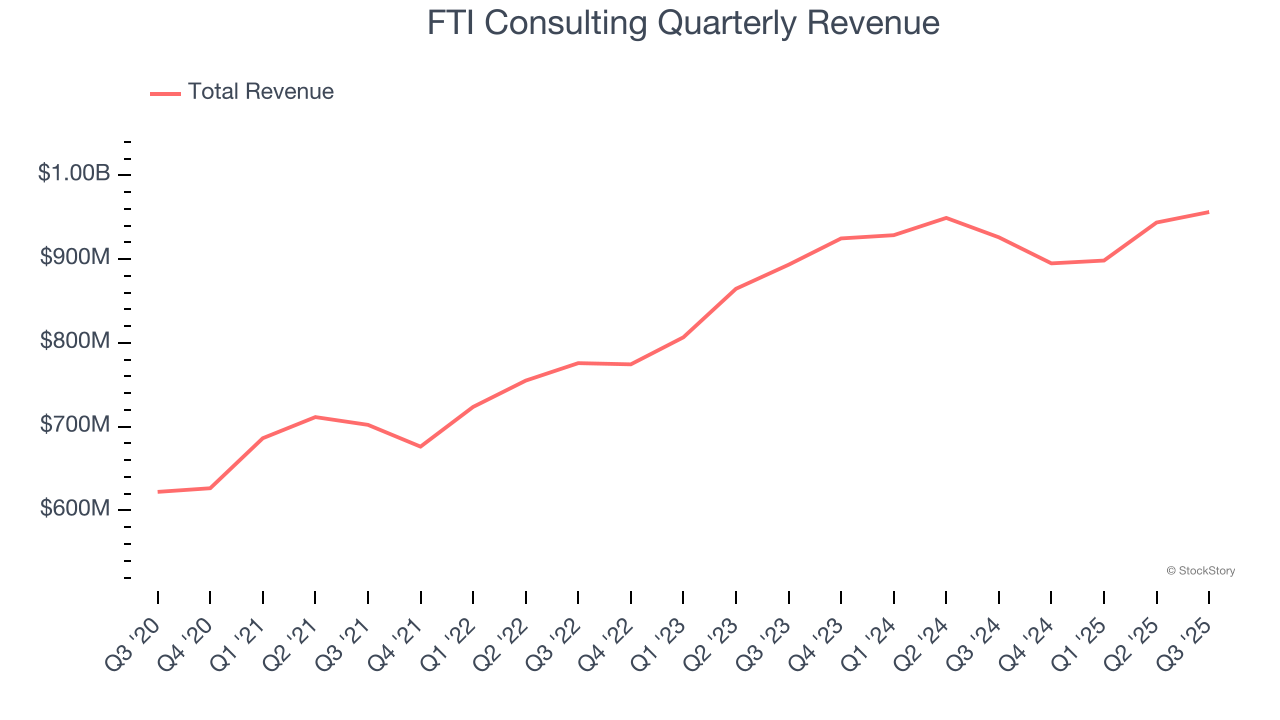

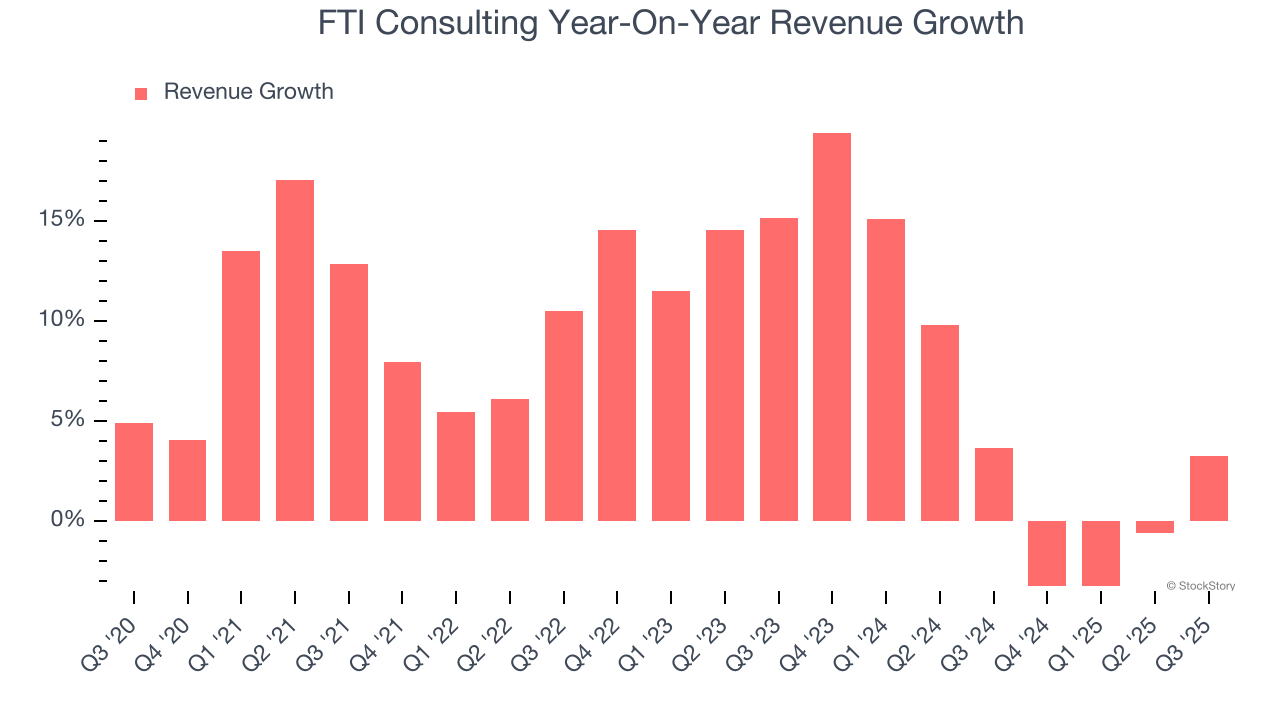

As you can see below, FTI Consulting’s sales grew at a solid 8.7% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. FTI Consulting’s annualized revenue growth of 5.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, FTI Consulting reported modest year-on-year revenue growth of 3.3% but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its two-year rate. This projection is above the sector average and suggests its newer products and services will help sustain its recent top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

FTI Consulting has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.4%, higher than the broader business services sector.

Analyzing the trend in its profitability, FTI Consulting’s operating margin decreased by 2.7 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, FTI Consulting generated an operating margin profit margin of 12.3%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

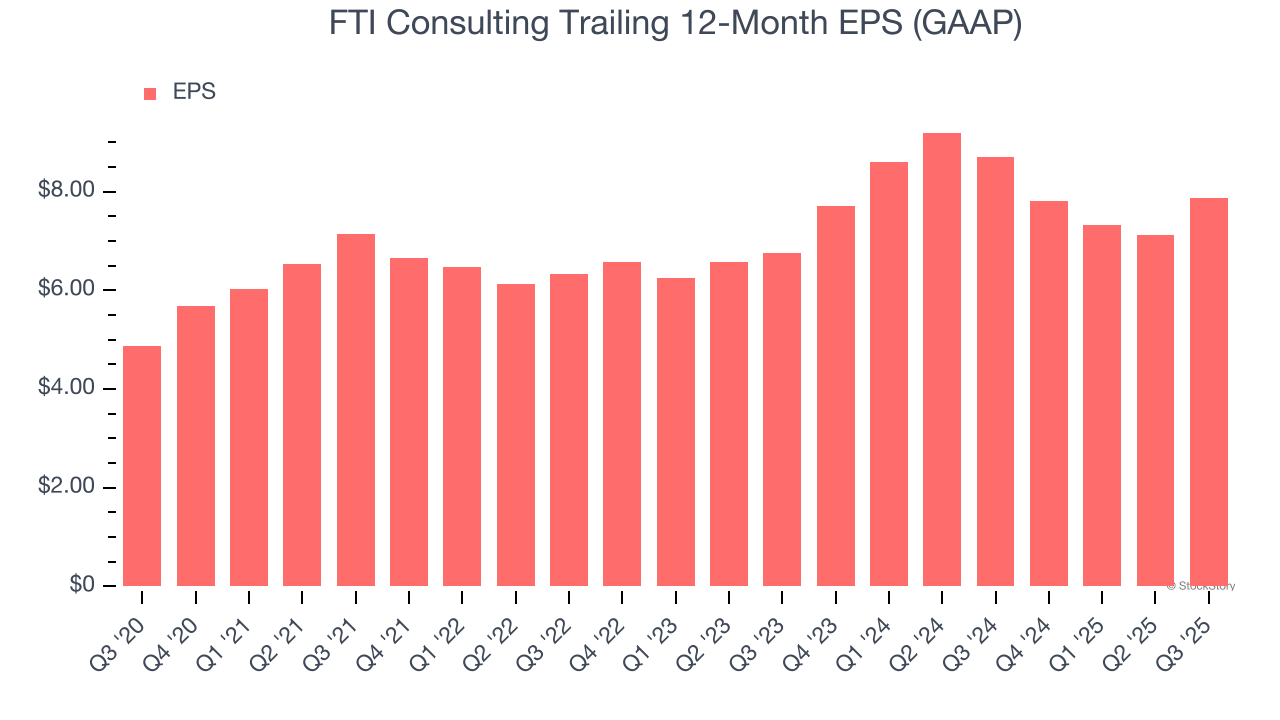

FTI Consulting’s solid 10% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it wasn’t great, FTI Consulting’s two-year annual EPS growth of 7.9% topped its 5.2% two-year revenue growth.

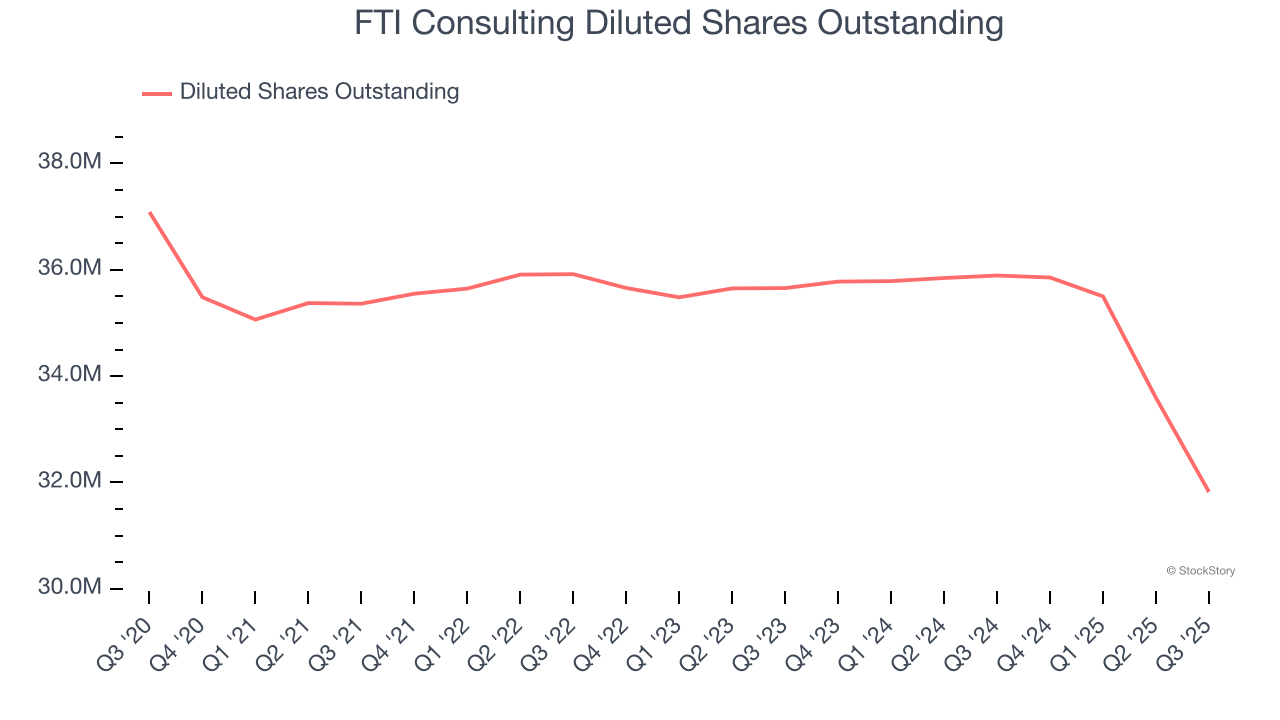

We can take a deeper look into FTI Consulting’s earnings to better understand the drivers of its performance. A two-year view shows that FTI Consulting has repurchased its stock, shrinking its share count by 10.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, FTI Consulting reported EPS of $2.60, up from $1.85 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FTI Consulting’s full-year EPS of $7.86 to grow 5.6%.

Key Takeaways from FTI Consulting’s Q3 Results

It was good to see FTI Consulting beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance was in line. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.1% to $157.50 immediately after reporting.

Indeed, FTI Consulting had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.