IQVIA has had an impressive run over the past six months as its shares have beaten the S&P 500 by 11.8%. The stock now trades at $200.20, marking a 39.8% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy IQVIA, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is IQVIA Not Exciting?

Despite the momentum, we're swiping left on IQVIA for now. Here are three reasons we avoid IQV and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

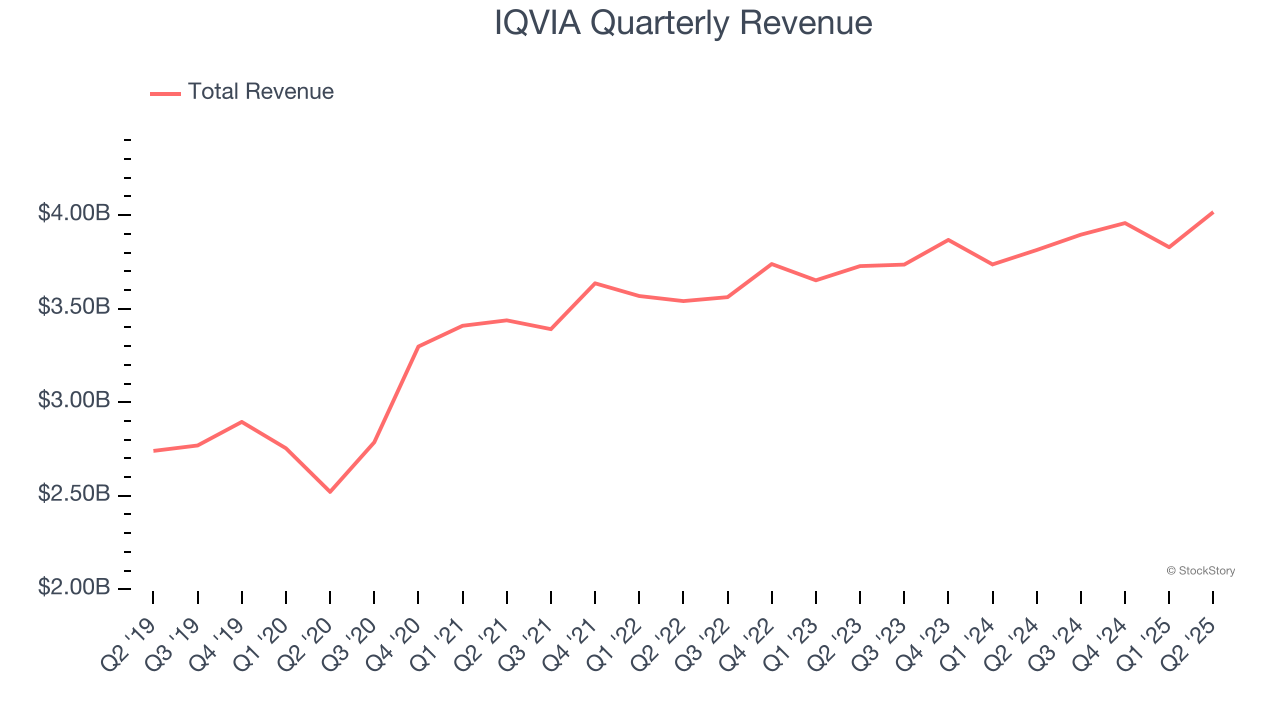

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, IQVIA’s 7.5% annualized revenue growth over the last five years was mediocre. This was below our standard for the healthcare sector.

2. Weak Constant Currency Growth Points to Soft Demand

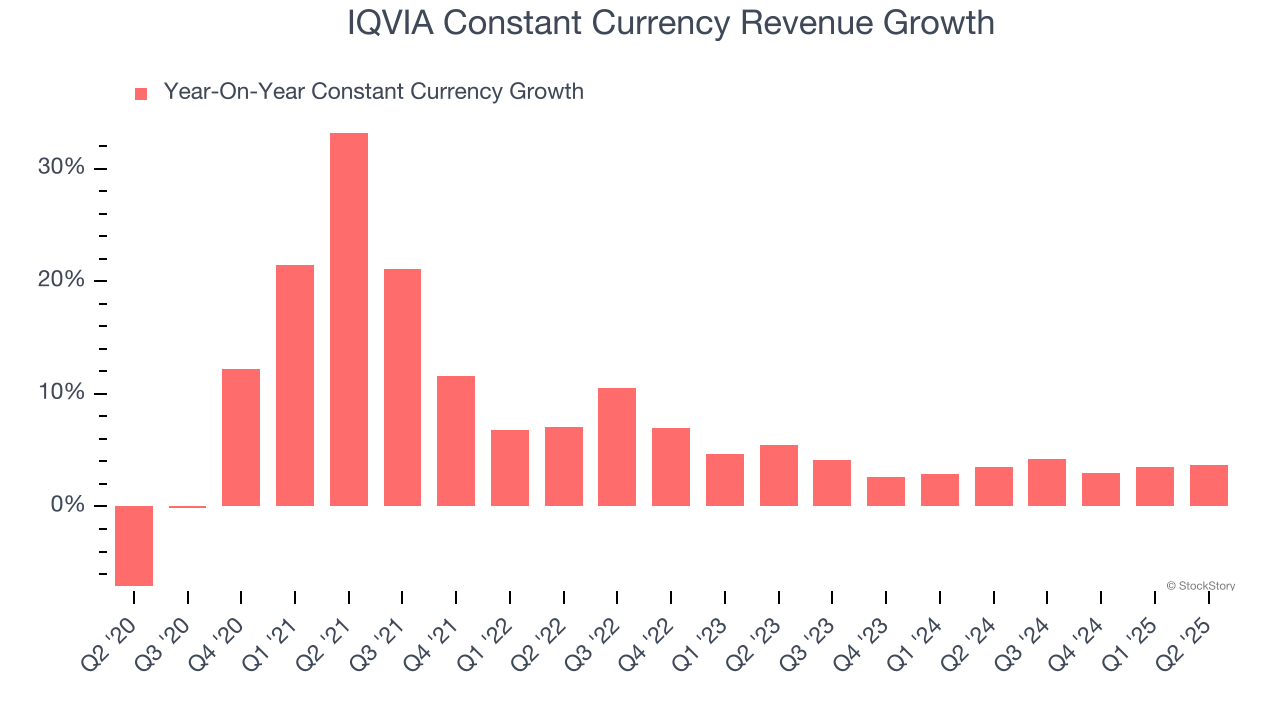

We can better understand Drug Development Inputs & Services companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of IQVIA’s control and are not indicative of underlying demand.

Over the last two years, IQVIA’s constant currency revenue averaged 3.4% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

3. Free Cash Flow Margin Dropping

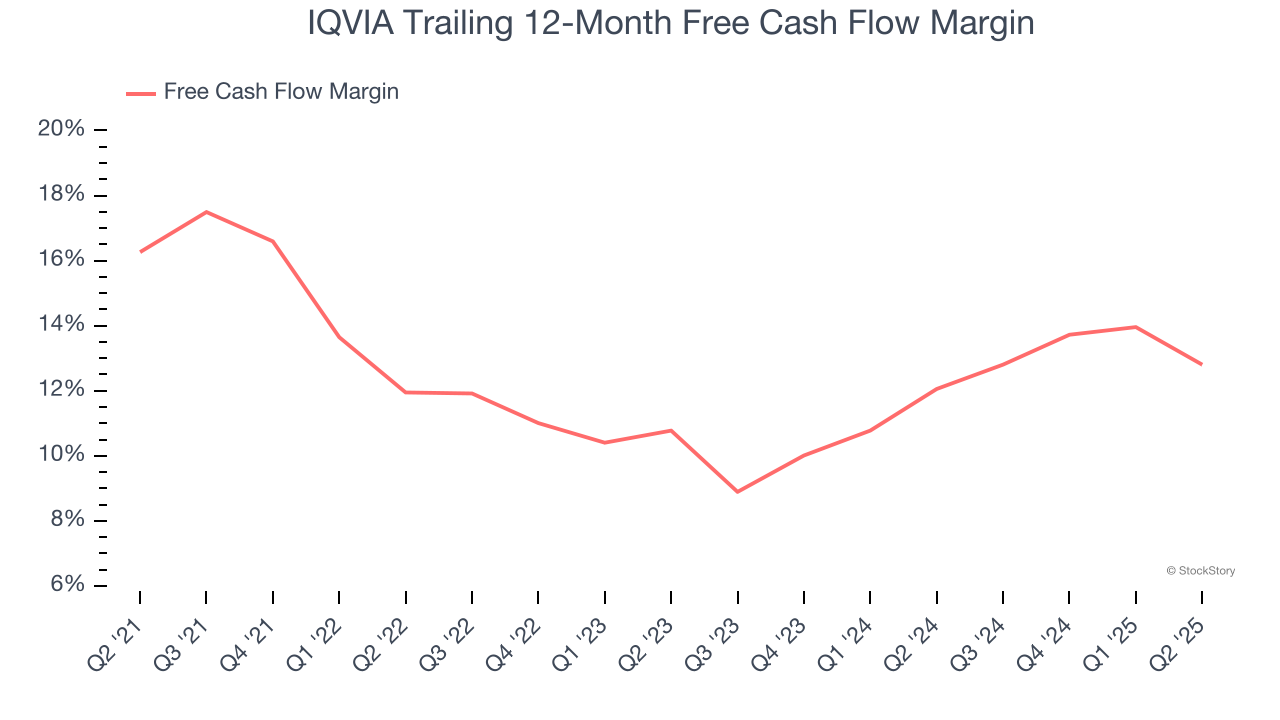

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, IQVIA’s margin dropped by 3.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. IQVIA’s free cash flow margin for the trailing 12 months was 12.8%.

Final Judgment

IQVIA isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 16.4× forward P/E (or $200.20 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than IQVIA

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.