Franklin Lakes, New Jersey-based Becton, Dickinson and Company (BDX) is a medical technology company with a market cap of $57.8 billion. The company is ready to announce its fiscal Q1 earnings for 2026 in the near future.

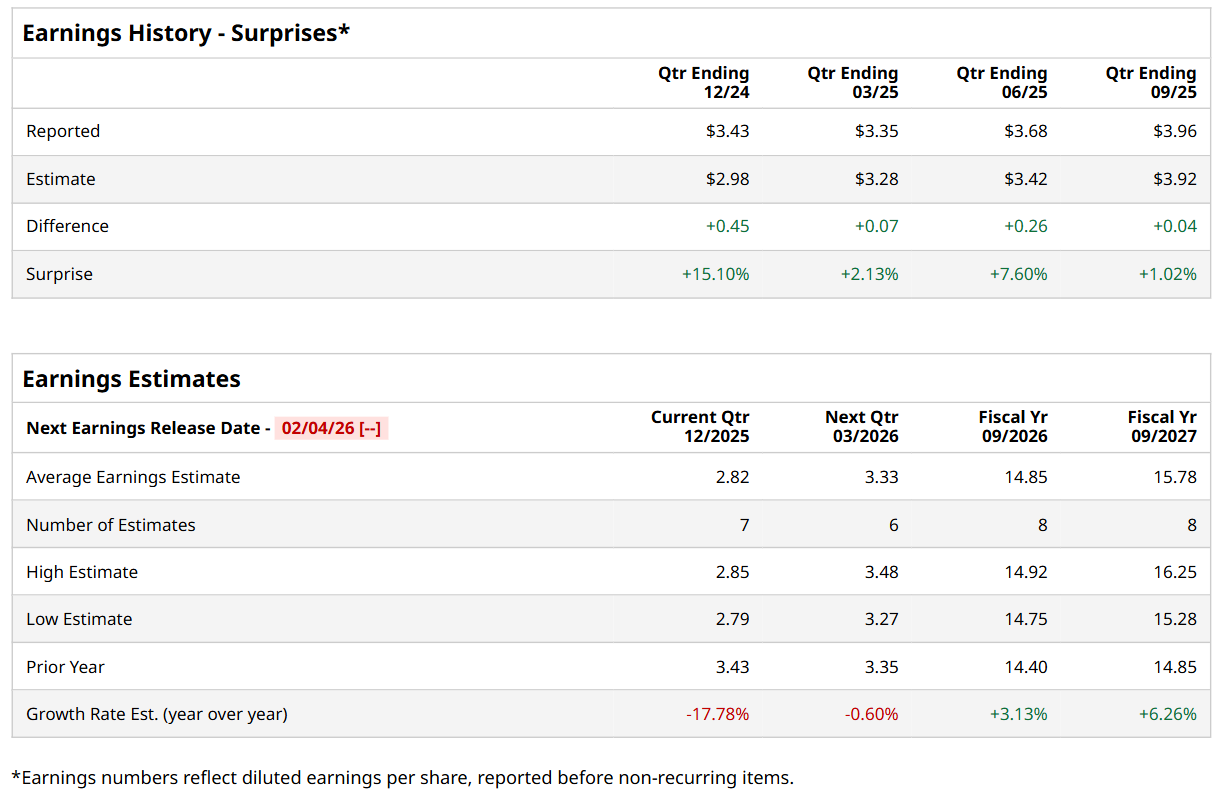

Before this event, analysts expect this healthcare company to report a profit of $2.82 per share, down 17.8% from $3.43 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q4, its EPS of $3.96 exceeded the consensus estimates by 1%.

For fiscal 2026, ending in September, analysts expect BDX to report a profit of $14.85 per share, up 3.1% from $14.40 per share in fiscal 2025. Furthermore, its EPS is expected to grow 6.3% year-over-year to $15.78 in fiscal 2027.

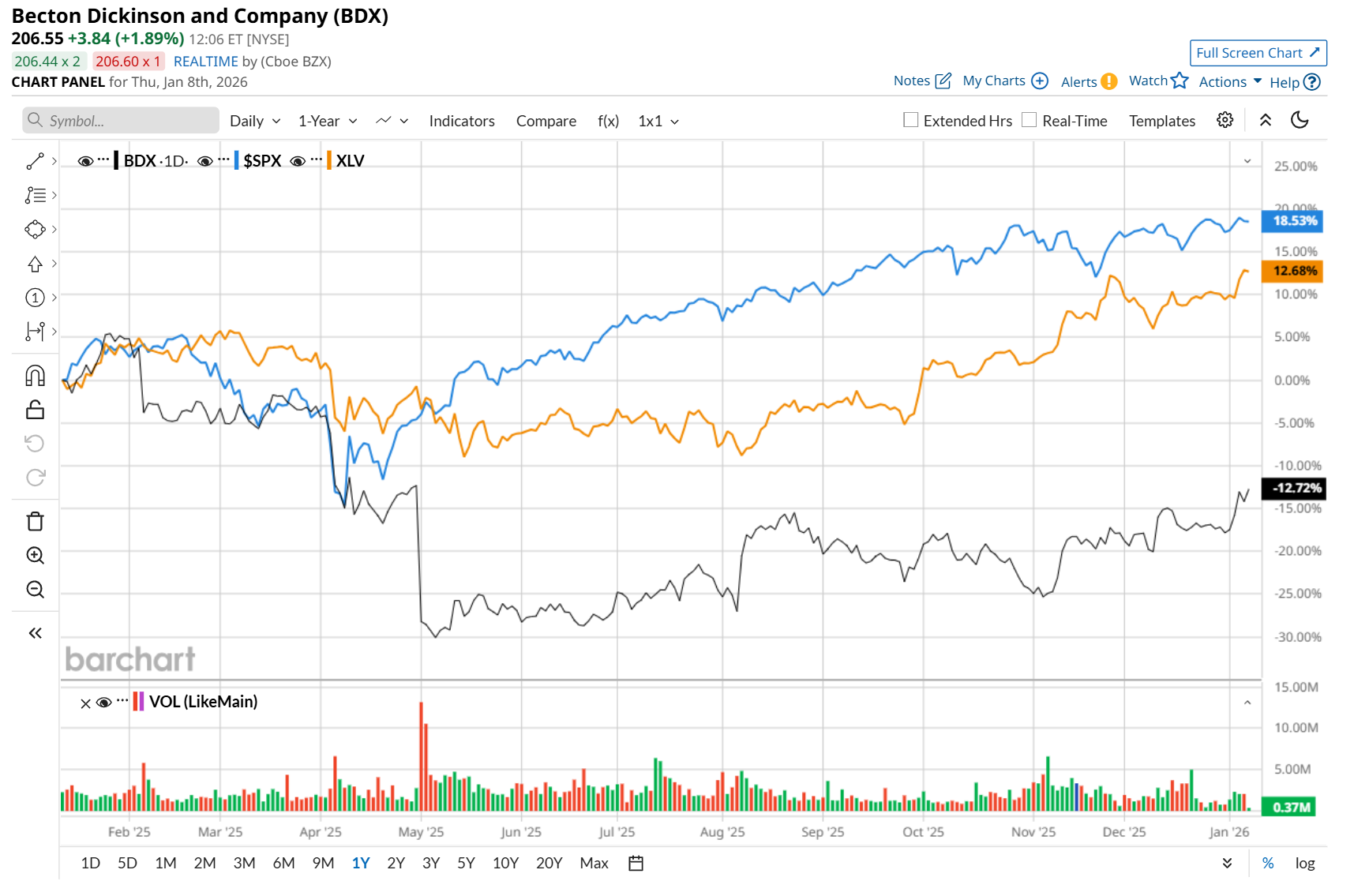

Shares of BDX have declined 12% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 17.1% return and the State Street Health Care Select Sector SPDR ETF’s (XLV) 13.7% uptick over the same time period.

Shares of BDX closed up marginally after its Q4 earnings release on Nov. 6. Due to strong demand across its medical and interventional segments, the company’s total revenue increased 8.3% year-over-year to $5.9 billion, meeting consensus estimates. Moreover, its adjusted EPS came in at $3.96, up 3.9% from the year-ago quarter and 1% ahead of analyst expectations.

Wall Street analysts are moderately optimistic about BDX’s stock, with a "Moderate Buy" rating overall. Among 12 analysts covering the stock, four recommend "Strong Buy," and eight suggest "Hold.” The mean price target for BDX is $230, indicating an 11.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jeff Bezos Launched a Secretive AI Startup in 2025 That Should Give Wall Street Chills

- It’s ‘As Important as Electricity’: Jensen Huang Says Nvidia Is ‘At the Center of the Single Most Important Industrial Revolution in Human History’

- Follow the Smart Money: 2 Undervalued Stocks With Aggressive Share Buybacks and Unusual Options Activity

- Warren Buffett Loved American Express Stock. With the Oracle of Omaha Now in Retirement, How Should You Play AXP in 2026?