Baidu (BIDU) announced plans to spin off its artificial intelligence chip subsidiary Kunlunxin through a Hong Kong IPO, sending shares higher on Friday. While details of the offer size are yet to be decided, the Chinese tech giant filed a confidential listing application with the Hong Kong Stock Exchange. Baidu expects to maintain majority ownership of Kunlunxin following the spinoff, which still requires regulatory approvals.

The move reflects Beijing's push for semiconductor self-sufficiency amid escalating U.S.-China tech tensions. Washington has restricted access to advanced Nvidia (NVDA) chips for Chinese AI companies. At the same time, Beijing has mobilized billions in public funding for domestic chip development and encouraged state-owned enterprises to buy locally.

Several Chinese chipmakers, including Moore Threads and Biren Technology, have announced similar listing plans in recent months. Founded in 2012, Kunlunxin sits at the center of Baidu's ambition to become a full-stack AI company spanning hardware, data centers, AI models, and applications.

While Baidu still relies heavily on Nvidia chips for computing power, Kunlunxin has enabled the company to deploy its self-developed chips in data centers that run its Ernie AI models. The unit has also expanded beyond internal use to sell chips to third-party customers, with external sales expected to account for more than half of revenue in 2025.

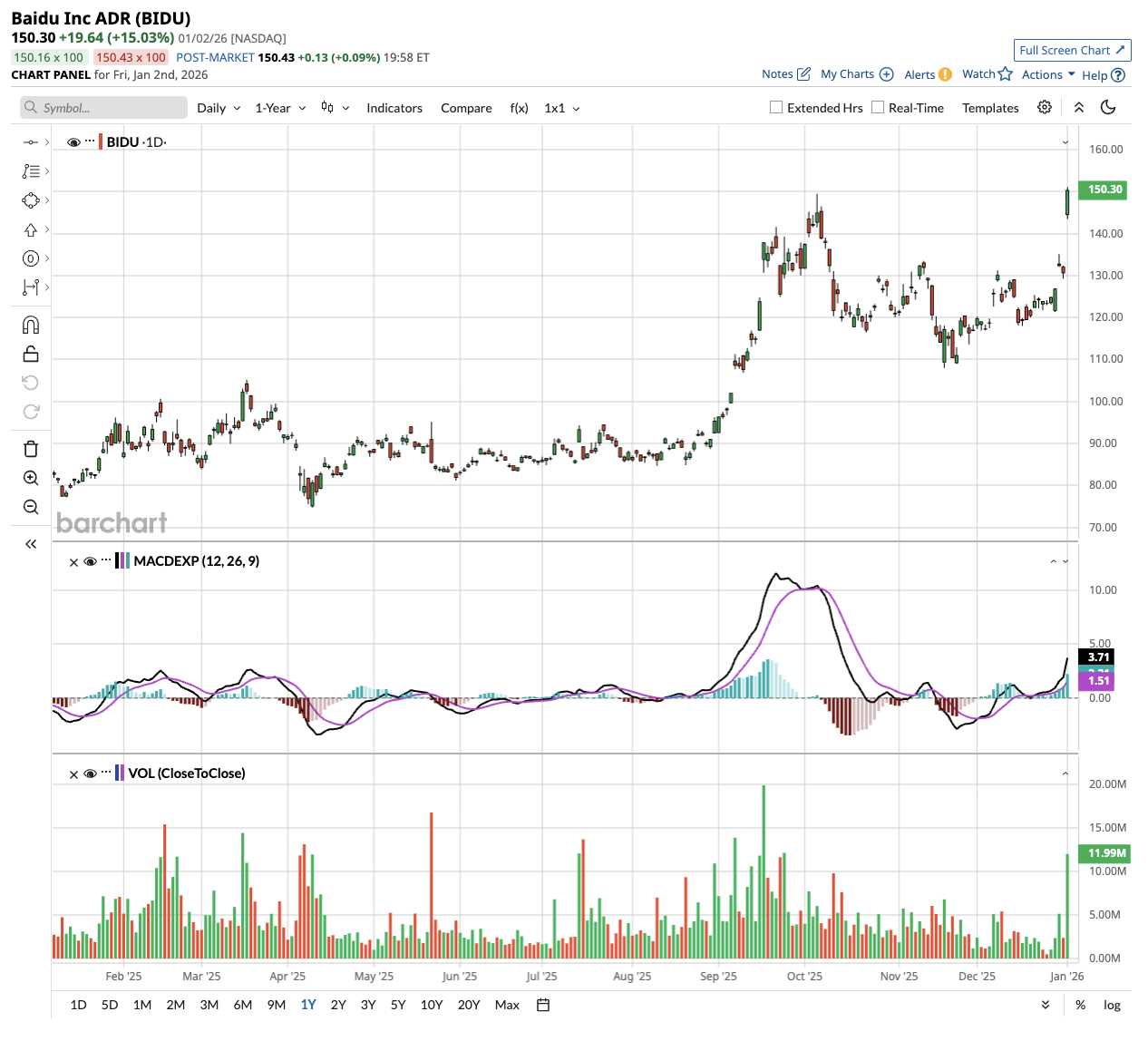

Valued at a market cap of $51.6 billion, Baidu stock has returned over 80% in 2025. Let’s see if you should own this tech stock right now.

Is Baidu Stock Still a Good Buy?

In Q3 of 2025, Baidu reported revenue of $4.4 billion, down 7% year-over-year (YoY). Notably, it posted a $2.3 billion impairment charge on outdated computing infrastructure that no longer meets current AI efficiency requirements. CEO Robin Li said the company wrote down older assets to create a healthier portfolio better aligned with advanced AI computing demands.

During the earnings call, Baidu provided visibility into its AI-powered businesses and future growth drivers. Its AI cloud infrastructure sales rose 33% to $588 million. Within this segment, subscription-based AI accelerator infrastructure revenue surged 128%, accelerating from a 50% growth last quarter.

This indicates strong underlying demand and a shift toward more recurring, higher-quality revenue. AI-native marketing services, including agents and digital humans, reached $392 million in revenue, skyrocketing 262% YoY.

These tools now account for 18% of Baidu Core's online marketing revenue, up from just 4% a year ago. The company said roughly 33,000 advertisers were generating daily ad spending through agents in September, while the number of “digital humans” livestreaming on the platform nearly tripled YoY.

Apollo Go, Baidu's robotaxi service, continues to gain massive traction. The business provided over three million fully driverless rides in the quarter, up 212% YoY and higher than the 148% growth in Q2.

Weekly average fully driverless rides exceeded 250,000 in October, among the highest levels globally. Apollo Go has now expanded to 22 cities, including new launches in Switzerland, Abu Dhabi, and Dubai. Li said several cities have achieved positive unit economics and expects more to turn profitable in 2026.

The AI transformation is creating near-term margin pressure. CFO Henry He acknowledged this represents a necessary trade-off, given Baidu is prioritizing user experience and AI investment over immediate monetization.

He expects margins to improve over the next 12 months as operational leverage from AI businesses begins to flow through.

What Is the BIDU Stock Price Target?

Analysts tracking BIDU stock forecast revenue to increase from $18.50 billion in 2025 to $24 billion in 2029. In this period, adjusted earnings per share are forecast to more than double, from $7.71 to $18.

If BIDU stock is priced at 19x forward earnings, which is similar to its 10-year average, it should trade around $342 in late 2028, indicating an upside potential of 128% from current levels.

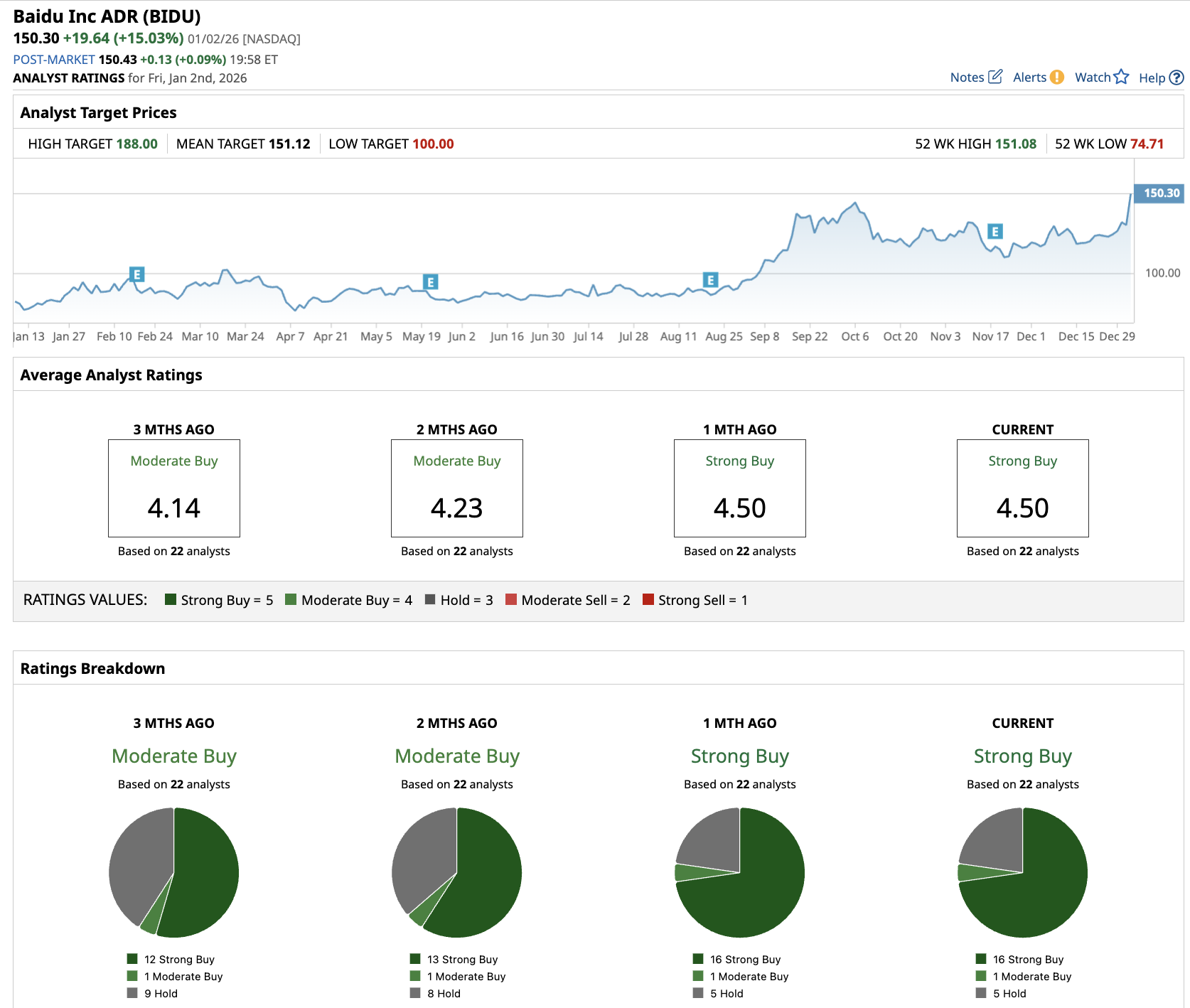

Out of the 22 analysts covering BIDU stock, 16 recommend “Strong Buy,” one recommends “Moderate Buy,” and five recommend “Hold.” The average BIDU stock price target is $151.12, which is very close to the current price of about $150.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Stock Just Surged Through Its 50-, 20-Day Moving Averages. Should You Buy INTC Here?

- Why a Marvell (MRVL) Options Shot from Outside the Arc Could Be the Smarter Move

- After a 130% Surge in 2025, Can Palantir Stock Keep Beating the Market in 2026?

- If You Like Digital Asset Treasury Stocks, You Need to Mark Your Calendars for January 15