In a move that’s shaking up the tech-scape and Wall Street alike, Apple (AAPL) has officially teamed up with long-time rival-turned-partner Alphabet (GOOG) (GOOGL) to overhaul Siri with cutting-edge artificial intelligence (AI) technology. Rather than building out its smartest virtual assistant entirely in-house, Apple will integrate Google’s powerful Gemini AI models into the next generation of Siri and Apple Intelligence features, a strategic shift aimed at catapulting Siri into the ranks of truly intelligent digital assistants.

The news has sparked ripples across tech markets: Google’s stock surged, and its market cap briefly topped $4 trillion, while analysts reignited interest in Apple’s growth trajectory around its AI pivot and upcoming product cycle.

The move reflects mounting pressure to deliver advanced AI capabilities after largely sitting out the AI boom and delaying a next-gen Siri upgrade. Apple said it is not changing its existing partnership with OpenAI, which currently powers ChatGPT integration in Siri for complex queries, leaving open questions about how the two AI partnerships will coexist going forward.

It remains to be seen whether outsourcing core AI capabilities to a competitor dilute Apple’s famed ecosystem advantage or will it be the meaningful catalyst to unlock further growth.

About Apple Stock

California-based Apple stands as a forward-looking company and a worldwide leader in hardware, software, and services. Its portfolio spans iconic devices like the iPhone, iPad, Mac, and Apple Watch, alongside widely used platforms such as the App Store, iCloud, Apple Music, and Apple TV+. The company currently boasts a market cap of $3.75 trillion and a Magnificent Seven status.

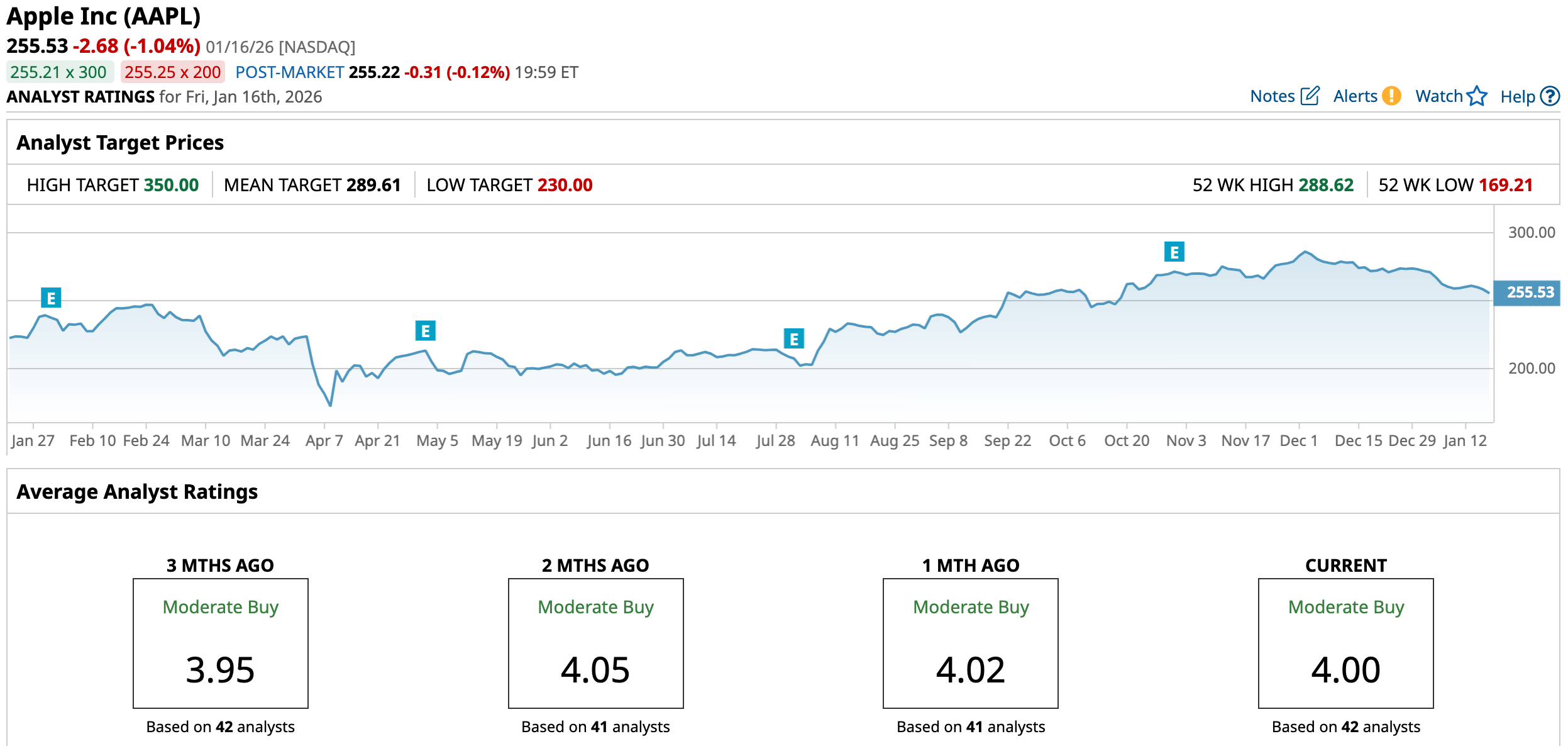

Over the past 52-week period, Apple’s stock has delivered gains of 11.95%. The stock advanced in late 2025 and hit a 52-week high of $288.62 on Dec. 3, 2025. Robust demand for the iPhone 17 series, upbeat earnings reports, and positive analyst revisions contributed to expanding investor confidence, while broader optimism around Apple’s future growth trajectory helped lift shares.

However, in early January 2026 Apple’s stock saw some profit-taking with the stock experiencing a streak of declines, falling for seven consecutive trading sessions since Dec. 30.

Following the announcement of Apple’s AI partnership with Google, the immediate price reaction for AAPL was muted. Apple’s stock exhibited only modest movement, suggesting that investors may have already priced in expectations around the company’s strategic shift or remain focused on longer-term catalysts rather than short-term headline impacts.

The stock is trading at a premium at 31.78 times forward earnings, compared to the sector median and its historical average.

Steady Q4 Results

Apple released its fiscal Q4 2025 results on Oct. 30, for the quarter ended Sept. 27. The company reported total revenue of $102.5 billion, representing an 8% year-over-year (YOY) increase. Its earnings per share (EPS) came to $1.85, up 13% on an adjusted basis from the prior year and ahead of expectations. AAPL reported total revenue of $416.2 billion for the full year, representing 6.4% growth YOY.

In terms of business segments, the iPhone division generated approximately $49 billion in revenue for the quarter, marking a 6.1% increase and accounting for nearly half of the company’s quarterly sales. Mac revenue rose about 12.7% to $8.7 billion, while iPad revenue was essentially flat at about $7 billion. The Wearables, Home & Accessories segment also saw flat performance, around $9 billion.

Meanwhile, the Services segment achieved an all-time high of $28.8 billion, growing about 15.1% YOY.

Apple now projects revenue growth of 10% to 12% in the holiday quarter (December quarter), driven by an anticipated double-digit increase in iPhone revenue. It expects December revenue to be “best ever” for iPhone. Gross margin for the period is expected to range between 47% to 48%, while Apple also noted ongoing investments in AI and product development, highlighting that while hardware continues to anchor the business, services and ecosystem strength remain a central focus.

Analysts covering Apple predict its EPS to rise by 10.4% YOY to $2.65 in the first quarter (about to be reported on Jan. 29). Further, the consensus estimate of $8.13 for fiscal 2026 indicates an increase of 9% YOY, before improving by around 12.2% annually to $9.12 in fiscal 2027.

What Do Analysts Expect for Apple Stock?

Following the announcement of the multi-year partnership with Google, Evercore ISI reiterated an “Outperform” rating on Apple with a $330 price target, citing the deal as a strategic way for Apple to “get the best of both worlds.” Also, earlier this month, BofA Securities reiterated its “Buy” rating on Apple with a $325 price target.

On the other hand, KeyBanc Capital Markets reiterated its “Sector Weight” rating on Apple, citing mixed consumer spending trends.

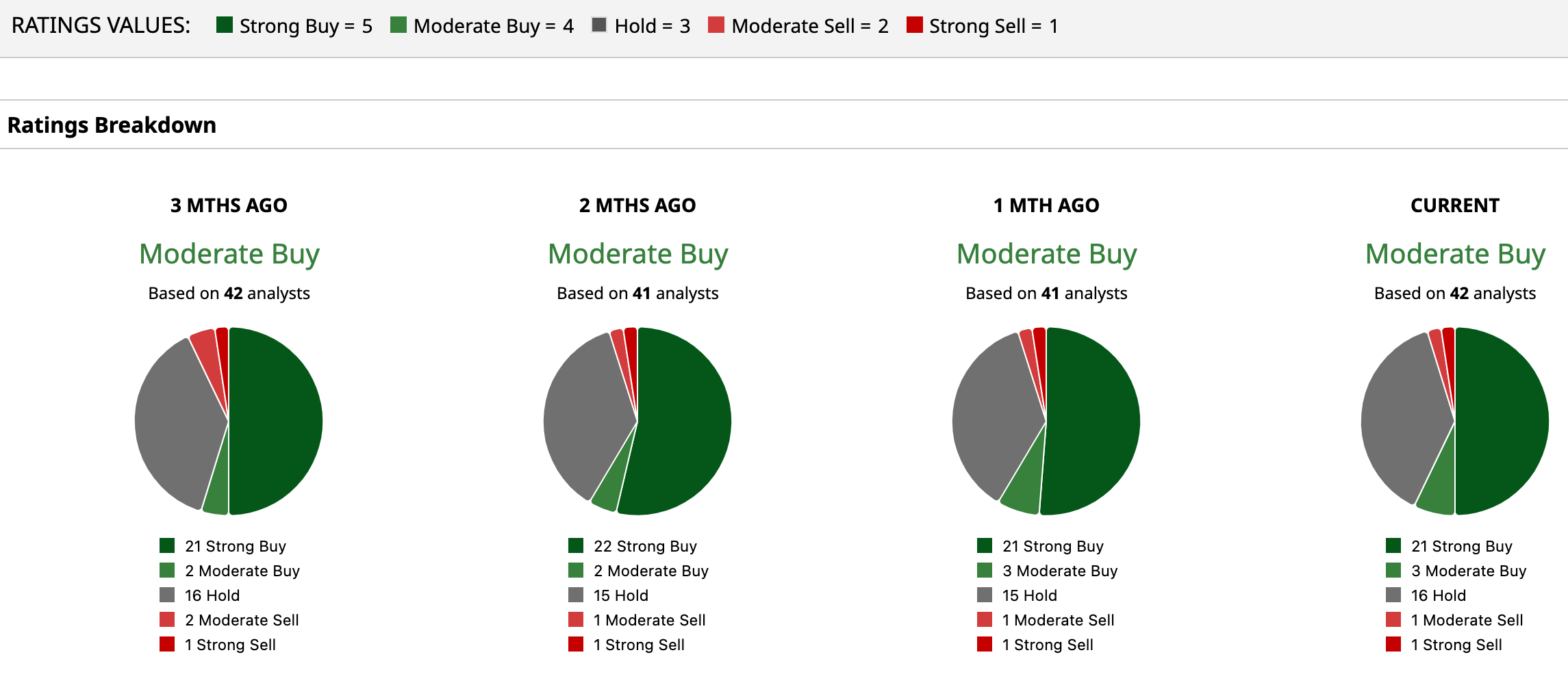

Apple stock has a consensus “Moderate Buy” rating overall. Out of 42 analysts covering the tech giant, 21 recommend a “Strong Buy,” three give a “Moderate Buy,” 16 analysts stay cautious with a “Hold” rating, one “Moderate Sell,” and one has a “Strong Sell” rating.

While the average analyst price target of $289.61 suggests an upside of 13.4%, its Street-high target price of $350 suggests nearly 37% upside ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart