President Donald Trump recently proclaimed that “The United States Government Is Proud to Be a Shareholder of Intel,” drawing fresh attention to one of the world’s most influential semiconductor companies. Under a landmark agreement struck last year, the federal government now holds an 8.9% equity stake in Intel Corporation (INTC), a position acquired via converted CHIPS Act and Secure Enclave program funds.

Trump’s endorsement has already moved markets. On Jan. 9, Intel shares jumped 10.8% after CEO Lip-Bu Tan met with President Donald Trump, extending a rally that has significantly propelled the stock since the U.S. government took a stake in the company last August. Trump publicly praised Intel’s U.S.-made chip production and reaffirmed federal support, while Tan highlighted the shipment of Intel’s new Core Ultra Series 3 processors built on the Intel 18A process.

So, let’s discuss whether the government’s faith in Intel’s turnaround will translate into durable competitive advantages.

About Intel Corporation Stock

Intel Corporation is a leading technology company specializing in the design, development, manufacture and marketing of semiconductor products, including microprocessors, chipsets, graphics processing units (GPUs), memory and related hardware for consumer, enterprise and industrial markets. Headquartered in Santa Clara, California, Intel remains a key player in data center, PC and emerging AI and networking segments. Intel’s market cap is around $210.5 billion, reflecting its valuation among the world’s largest semiconductor companies.

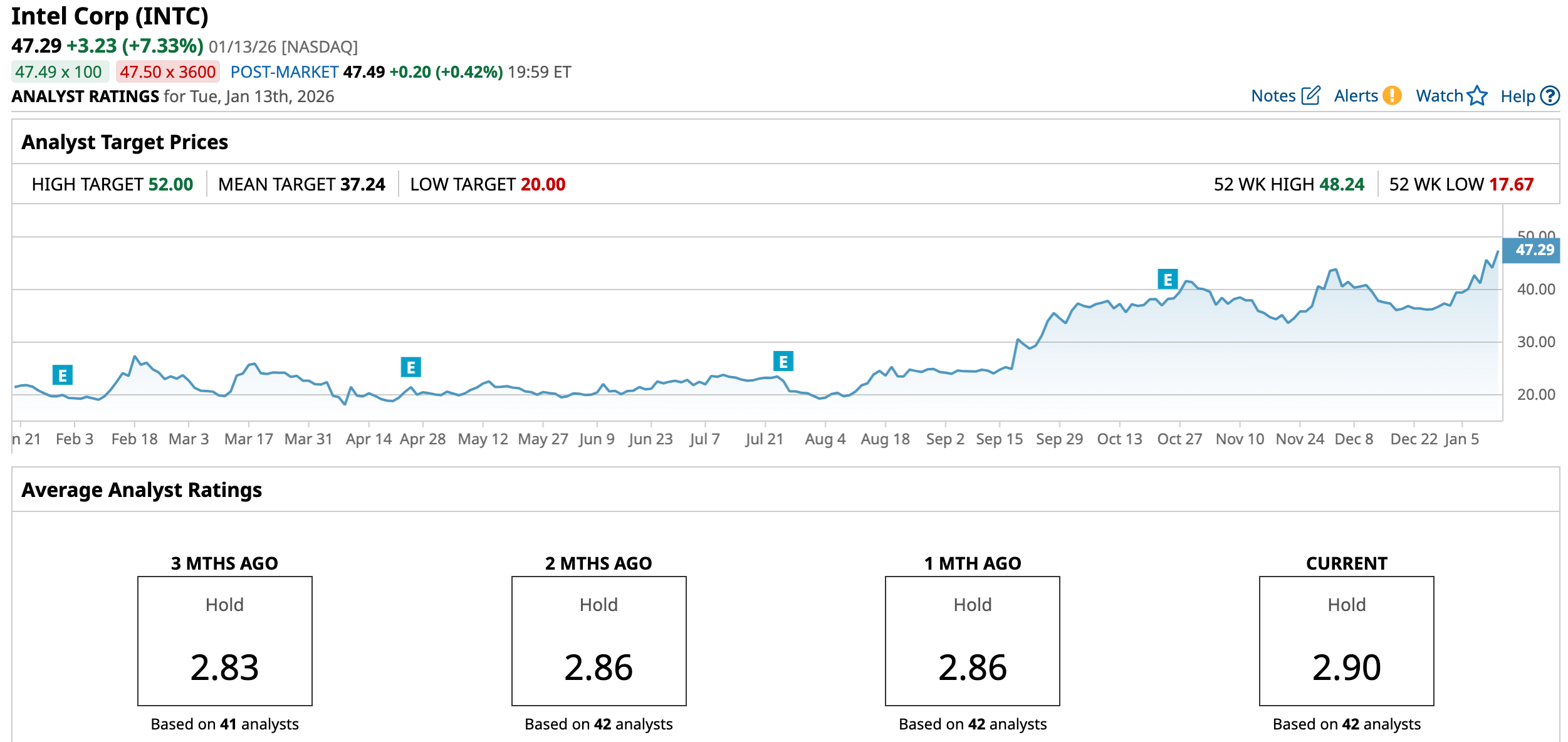

Intel’s stock price action over the past year has been nothing short of dramatic, transforming from a laggard in the semiconductor sector to one of the market’s most talked-about turnaround stories. After languishing at lows of around $17.67 earlier in 2025, Intel’s stock began a steep climb.

A major catalyst behind this rebound has been the U.S. government’s direct investment via the Trump administration’s deal to acquire a significant stake in the company at about $20.47 per share in Aug. 2025, a move aimed at strengthening domestic semiconductor manufacturing. Since then, as Intel’s share price climbed and closed on Jan. 13 at $37.29, the U.S. government stake has more than doubled in value, underscoring the potent combination of political backing and market momentum.

On a 52-week basis, the stock has delivered 146.3% returns, outperforming broad market averages over the period. The rally has been punctuated by spikes tied to political endorsements and product news, such as the 10.8% intraday gains on Jan. 9, following the high-profile meeting between Intel’s CEO and President Trump. The stock also hit a fresh 52-week high of $45.73 during that session.

Despite the eye-popping run, some Wall Street analysts remain cautious about the sustainability of these gains amid competitive pressures in PCs and data centers.

The stock is currently trading at a premium to its sector median at 269 times forward earnings.

Q3 Report Showcased Intel’s Progress in Returning to Growth and Profitability

Intel released its Q3 2025 earnings report on Oct. 23, 2025. Revenue for the quarter came in at $13.7 billion, representing a 3% year-over-year (YOY) increase from about $13.3 billion in Q3 2024. Gross margins improved dramatically to 38.2% from just 15% a year earlier, reflecting better cost discipline and product mix.

When breaking down the performance, the Client Computing Group (CCG) led the way with $8.5 billion in revenue, up about 5% YOY, while the Data Center and AI (DCAI) unit generated roughly $4.1 billion, slightly down from the prior year. Intel Foundry reported $4.2 billion in revenue, modestly down YOY.

Net income swung into positive territory with $4.1 billion, compared with a $16.6 billion loss in the same period last year, while non-GAAP EPS was $0.23, reversing a prior loss and exceeding consensus expectations. Overall operating performance was bolstered by cost reductions and stronger sales in client computing.

Furthermore, Intel provided guidance for Q4 2025, projecting revenue between $12.8 billion and $13.8 billion with expected EPS on a non-GAAP basis of $0.08.

Analysts predict loss per share to be around $0.14 for fiscal 2025, an improvement of 83.5% YOY, before surging by 221.4% annually to an EPS of $0.17 in fiscal 2026.

What Do Analysts Expect for Intel Stock?

Melius Research recently upgraded Intel’s stock from a “Hold” rating to a “Buy,” while setting a price target of $50, signaling growing confidence in the company’s turnaround and long-term prospects.

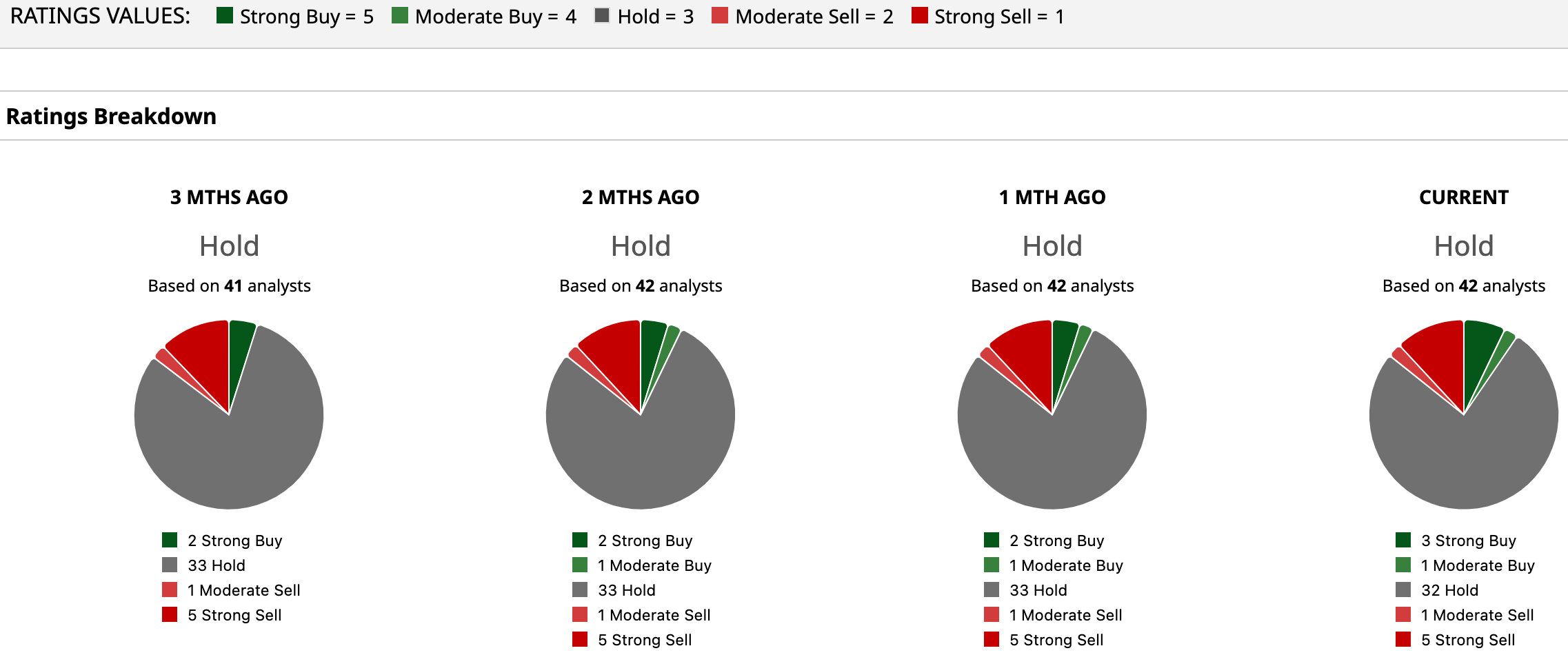

However, overall, INTC has a consensus “Hold” rating, indicating a cautious stance. Of the 42 analysts covering the stock, three advise a “Strong Buy,” one recommends a “Moderate Buy,” 32 analysts are on the sidelines, giving it a “Hold” rating, one suggests a “Moderate Sell,” and five propose a “Strong Sell.”

INTC has already surged past the average analyst price target of $37.24, while the Street-high target price of $52 suggests that the stock could rally as much as 9.96%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Broadcom CEO Hock Tan Just Sold $24 Million Worth of AVGO Stock. Should You Dump Shares Too?

- HSBC Says These 2 AI Stocks Are Likely to Be Earnings Winners. Should You Buy Them Now?

- Behind Berkshire’s Curtain: Is Greg Abel Preparing to Cut Davita Loose?

- Thursday Earnings Preview: Look to These Banking Giants for Key Consumer Insights