Maplebear’s Instacart (CART) has been on shaky ground this year as competition in grocery delivery intensifies. Well-funded rivals like Amazon (AMZN), Walmart (WMT), and other delivery platforms are leveraging their scale, logistics networks, and partnerships to squeeze Instacart’s market share. At the same time, mounting business and regulatory challenges have dented investor confidence.

That pressure intensified on Dec. 18, when CART shares slipped about 1.5% following reports that Instacart agreed to pay $60 million in consumer refunds as part of a settlement with the Federal Trade Commission (FTC). The FTC alleged that the company used deceptive tactics tied to subscription sign-ups and its “100% satisfaction guarantee” advertisement, resulting in higher fees and making refunds difficult to obtain.

Compounding those concerns, Instacart is reportedly facing a separate FTC probe into its pricing practices, after a recent study suggested its algorithmic pricing tools led shoppers to pay different prices for identical items at the same store. With regulatory headwinds intensifying, does this pullback present a buying opportunity, or are the risks still too high?

About Instacart Stock

Founded in 2012, Instacart has become a central player in North America’s grocery ecosystem, operating at the intersection of retailers, consumers, and on-demand fulfillment. The company works with more than 1,800 national, regional, and local retail banners, enabling online shopping, delivery, and pickup from nearly 100,000 stores through the Instacart Marketplace.

This network allows millions of consumers to shop from familiar retailers while supporting roughly 600,000 shoppers who earn income by picking, packing, and delivering orders on flexible schedules. At the same time, the California-based company has expanded beyond delivery into a broader technology platform for retailers. Its enterprise-grade tools help power e-commerce experiences, fulfill orders, digitize brick-and-mortar stores, deliver advertising solutions, and generate actionable insights.

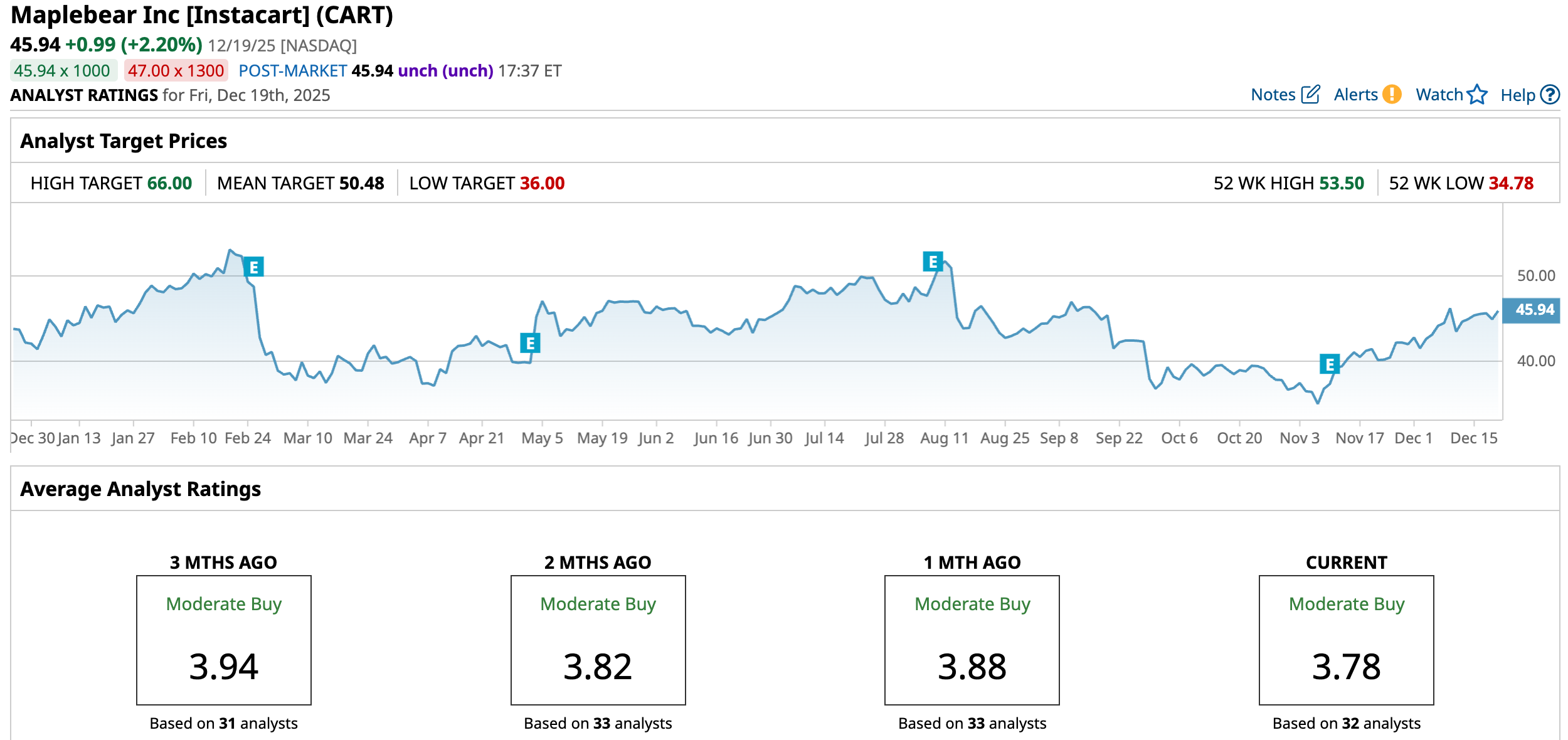

Public since 2023, Instacart currently has a $12 billion market capitalization, but the stock hasn’t lived up to broader market strength. Shares peaked at $53.50 in August this year and have since fallen nearly 17%. So far in 2025, CART is up about 10.9%, a respectable gain, but one that still lags the broader S&P 500 Index ($SPX), which has advanced 16.2% over the same stretch.

Inside Instacart’s Q3 Earnings Report

On Nov. 10, Instacart dropped its fiscal 2025 third-quarter earnings report, which blew past both Wall Street’s top and bottom line expectations. Total revenue for the quarter jumped 10% year-over-year (YOY) to $939 million and also came in ahead of Wall Street’s expected figure of $934.1 million. Gross transaction value (GTV), which tracks the value of goods sold, also climbed 10% YOY to $9.17 billion, while total orders surged 14% to 83.4 million, driven by higher demand for essentials and optimized logistics.

Revenue growth was broad-based. Transaction revenue reached $670 million, up 10% year over year and representing 7.3% of GTV. At the same time, advertising and other revenue increased to $269 million, also up 10%, accounting for 2.9% of GTV. The company’s profitability story also strengthened meaningfully. Adjusted EBITDA jumped 22% to $278 million, reflecting operating leverage and the impact of deeper retailer partnerships.

A key highlight was the expansion of Instacart’s relationship with Kroger (KR), which reaffirmed Instacart as its primary delivery fulfillment partner across all Kroger digital properties, supporting fast and reliable delivery from nearly 2,700 stores nationwide. On the bottom line, EPS came in at $0.51, up 21.2% YOY and just ahead of the $0.50 consensus forecast.

Meanwhile, Artificial intelligence (AI) remains a growing driver across the business. During the quarter, Instacart upgraded its ad-relevance systems using large language models, boosting engagement and increasing the number of items added to carts via Sponsored Product units. The company also expanded its one-click, AI-powered recommendation tools to around 3,000 brands, helping them better optimize bids, budgets, and creative execution.

In addition, AI-generated landing pages are now available to all brands, allowing faster creation of dynamic, high-performing content for both on- and off-platform campaigns. To reinforce confidence in its long-term value creation, Instacart authorized a $1.5 billion increase to its share repurchase program and plans to initiate a $250 million accelerated share repurchase, while continuing to buy back shares opportunistically.

Looking ahead, the company expects fiscal 2025 Q4 GTV to land between $9.45 billion and $9.60 billion, alongside adjusted EBITDA of $285 million to $295 million. That outlook implies 9%-11% YOY GTV growth, with order volumes projected to grow even faster. Management cited strong October trends and continued momentum from new and expanded enterprise partnerships, while acknowledging that potential EBT SNAP funding impacts could partially offset those gains.

What Do Analysts Have to Say About Instacart Stock?

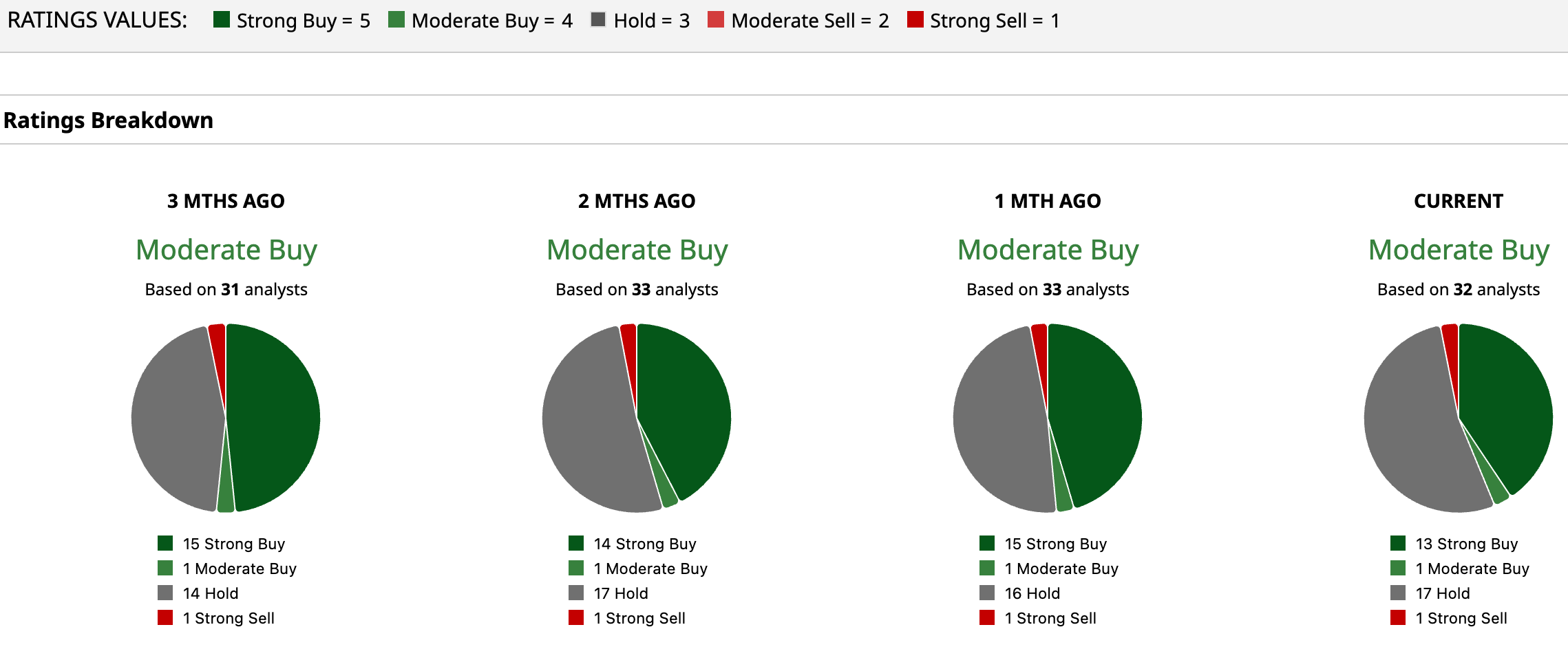

Even as regulatory concerns hang over the stock, Wall Street’s outlook on Instacart remains more constructive than bearish. CART currently carries a consensus “Moderate Buy” rating overall. Of the 32 analysts covering the company, 13 call it a “Strong Buy,” one recommends “Moderate Buy,” 17 advise “Hold,” and only one has a “Strong Sell” view.

That cautious confidence is also evident in price targets. The average target of $50.48 implies roughly 10% upside from current levels. At the same time, the most bullish call on the Street sees shares climbing to $66, indicating a 43.7% rally if Instacart can successfully navigate its regulatory challenges.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The 2 Riskiest Stocks Investors Are Betting On With Over 300% Upside

- Instacart Is Under Investigation. Should You Buy the Dip in CART Stock?

- The Saturday Spread: How a Little-Known Options Strategy Targets Asymmetric Upside (ORCL, NEE, IRM)

- Data Center Demand Is Transforming FuelCell Energy. Should You Buy FCEL Stock After Earnings?