Pennsylvania-based The Hershey Company (HSY) manufactures and sells confectionery products and pantry items in the U.S. and internationally. With a market cap of $33.6 billion, Hershey operates through North America Confectionery, North America Salty Snacks, and International segments.

The confectioner has notably underperformed the broader market over the past year. HSY stock has observed a marginal 31 bps uptick in 2025 and declined 5.7% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 15.6% gains on a YTD basis and 17.5% returns over the past year.

Narrowing the focus, Hershey has outpaced the sector-focused Consumer Staples Select Sector SPDR Fund’s (XLP) 3.4% dip in 2025 and 6.1% decline over the past year.

Despite reporting better-than-expected results, Hershey’s stock prices dipped 2.4% in the trading session following the release of its Q3 results on Oct. 30. The company observed a solid momentum in its sales during the quarter. Hershey’s organic constant currency sales increased 6.2% compared to the year-ago quarter. Meanwhile, its overall topline surged 6.5% year-over-year to $3.2 billion, beating the Street’s expectations by 1.8%. Meanwhile, its adjusted EPS decreased 44.4% year-over-year to $1.30, but surpassed the consensus estimates by a staggering 19.3%.

Despite the expectations beating performance, the company didn’t improve its full-year earnings guidance by much, which wasn’t received well by the market.

For the full fiscal 2025, ending in December, analysts expect HSY to deliver an adjusted EPS of $5.98, down 36.2% year-over-year. On a positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

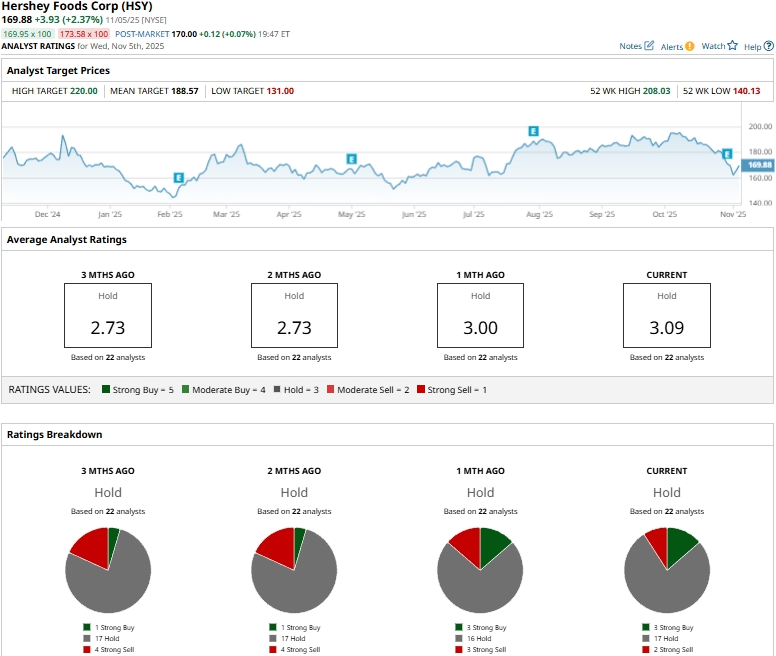

Among the 22 analysts covering the HSY stock, the consensus rating is a “Hold.” That’s based on three “Strong Buys,” 17 “Holds,” and two “Strong Sells.”

This configuration is notably more optimistic than two months ago, when only one analyst gave a “Strong Buy” recommendation and four analysts had “Strong Sell” ratings on the stock.

On Nov. 1, TD Cowen analyst Robert Moskow reiterated a “Hold” rating on HSY, but lowered the price target from $204 to $200.

HSY’s mean price target of $188.57 represents an 11% premium to current price levels. Meanwhile, the street-high target of $220 suggests a notable 29.5% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- AbbVie Just Raised Its Dividend by 5.5%. Should You Buy ABBV Stock Here?

- 1 High-Risk, High-Reward Way to Trade Earnings with 0DTE Options

- Is This ‘Strong Buy’ Aerospace Stock a Giant Steal in 2025?

- Alex Karp Says ‘We Were Right, You Were Wrong’ as Palantir Delivers Record Revenue. Should You Buy PLTR Stock Here?