Apple (AAPL) shares inched higher to print a new all-time high on Tuesday after the iPhone maker announced dozens of layoffs aimed at streamlining its sales department.

In its statement, the company said these job cuts primarily affected account managers serving enterprise, education, and government clients, as well as staff operating its briefing centers where institutional customers receive product demonstrations.

Following today’s surge, Apple stock is up nearly 65% versus its year-to-date low in early April.

What the Layoffs Really Mean for Apple Stock

The timing of these layoffs presents a compelling paradox, arriving as Apple approaches record-breaking financial performance with projected December quarter revenue of nearly $140 billion.

This disconnect between workforce reductions and exceptional revenue growth suggests the cuts represent strategic optimization rather than financial distress.

The tech behemoth has framed these changes as necessary streamlining to eliminate overlapping responsibilities within the sales organization and enhance operational efficiency.

Also on Tuesday, JPMorgan’s senior analyst Samik Chatterjee reiterated his “Overweight” rating on AAPL shares, projecting upside to $305 by the end of next year.

Why Is JPM Bullish on AAPL Shares?

In his research note, Chatterjee cited exceptional demand for the recently launched iPhone 17 for his constructive view on Apple shares.

According to him, recent channel checks confirm that consumer interest in the iPhone 17 lineup is outpacing supply heading into 2026.

He expects AAPL’s holiday quarter earnings to prove a near-term catalyst that drives its share price up further from current levels.

Moreover, at a forward price-earnings (P/E) ratio of less than 34x, Apple is attractively priced for an AI stock as well.

Apple is currently trading decisively above all of its moving averages (50-day, 100-day, 200-day), indicating it’s in a strong technical uptrend with sustained bullish momentum and investor confidence.

How Wall Street Recommends Playing Apple

What’s also worth mentioning is that JPM is among the more conservative firms as far as AAPL shares are concerned.

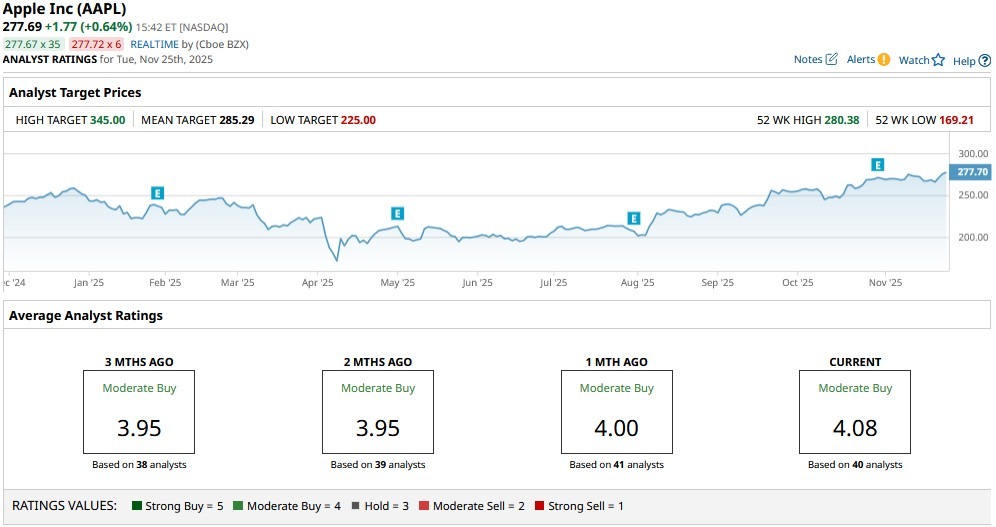

According to Barchart, the consensus rating on Apple stock currently sits at “Moderate Buy” with price targets going as high as $345 signaling potential upside of another 37% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart