CALGARY, AB / ACCESSWIRE / February 29, 2024 / Tocvan Ventures Corp. (the "Company") (CSE:TOC)(OTCQB:TCVNF)(FSE:TV3), is pleased to announce reverse circulation (RC) drilling is set to commence at its road accessible Pilar gold-silver project in the mine-friendly State of Sonora, Mexico.

After a year hiatus of drilling to focus on bulk sampling and land consolidation, the Company will now begin systematic drilling for resource definition and additional targeting across the Pilar property. The initial focus will be on infill and step-out targeting within and adjacent to the Pilar Main Zone including where previous drill campaigns successfully discovered the southern extension of the Main Zone, returning 108.6 meters of 0.8 g/t Au, including 9.4 meters of 7.6 g/t Au and 5 g/t Ag.

Sonora is one of the most cost-effective jurisdictions for exploration and development. The Company estimates all-in drill costs to be US$130 per meter which includes drilling, gold and multielement analysis, mobilization, geological and technical support. Assay Laboratory turnaround is currently ranging from 10 to 14 days allowing for rapid reporting and progressive target development. The Company has been working towards a long-term arrangement with a new Sonora-based drill company, Canmex Exploraciones y Servicios (CANMEX). The newly formed CANMEX is made up of management and operators with extensive experience in Sonora including several successful drill campaigns across the Company's Pilar and Picacho projects. Owned and operated by longtime Tocvan supporters Leo Wurtz and Gerardo Martinez, CANMEX has at their disposal three RC rigs, five diamond core rigs and two truck mounted water well rigs. All of this equipment can be utilized by the Company during the next phases of exploration and development. The arrangement allows for cost effective drilling to continue across both projects with a trusted local operator known for drilling excellence and environmental stewardship.

"We are extremely excited to restart drilling at Pilar after a long but necessary hiatus as we evaluated the metallurgical viability of the project and consolidated the area for additional targeting," commented Brodie Sutherland, CEO. "There is no shortage of targets, especially with the immediate extension of mineralization across the expansion area. We are equally excited to lock in a very competitive drill contract with a trusted partner as we shift to more aggressive drilling. The low cost and rapid turnaround of drill results will give us a great advantage as we look to continue to unlock the potential of Pilar and build towards resource definition and the ultimate goal of development."

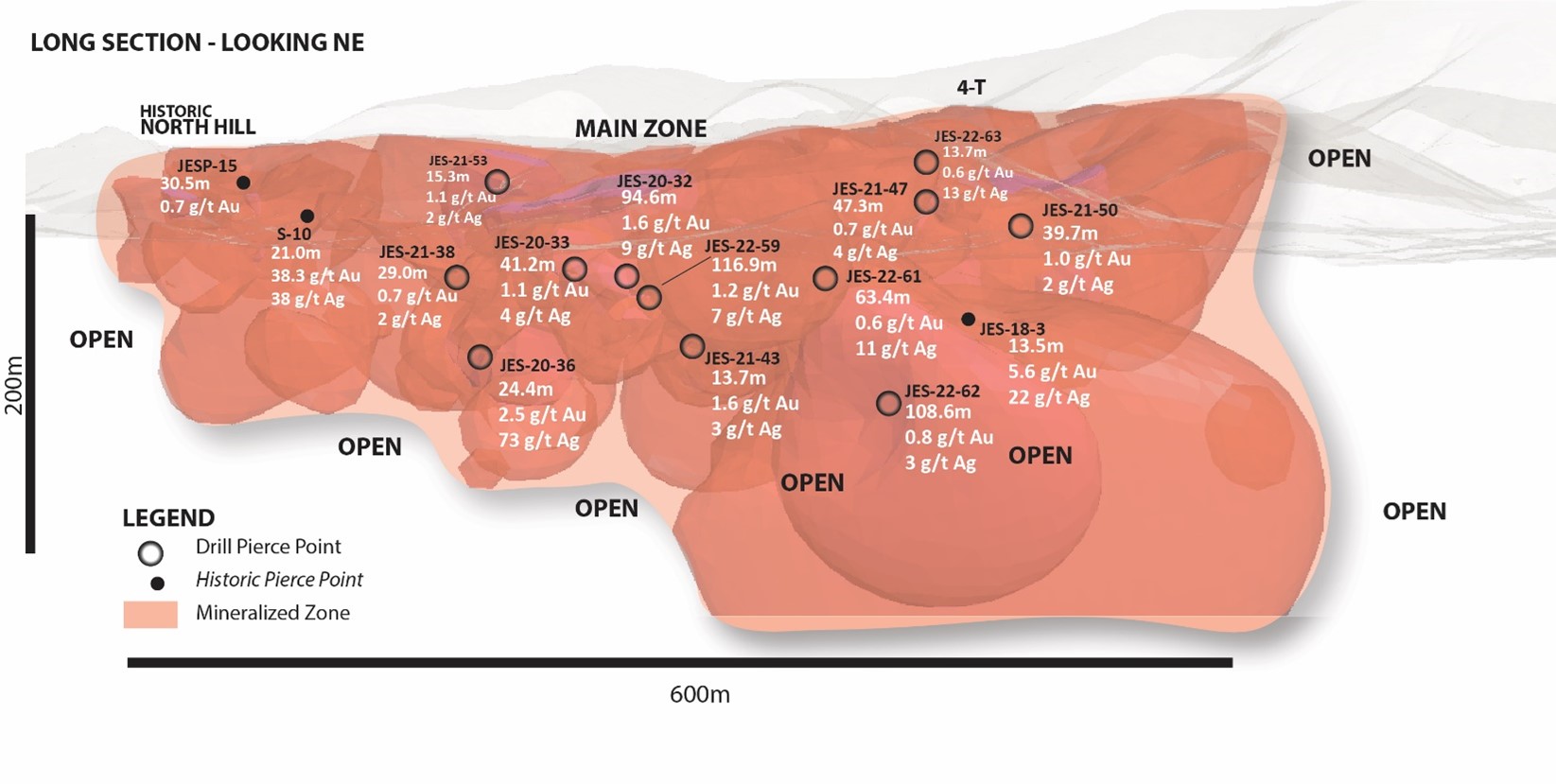

Figure 1. Pilar Long Section (looking northeast) with key highlight holes across the mineralized system. Interval lengths are drilled thicknesses. Mineralization remains open at depth and along strike with several parallel trends with limited drilling to date.

Drilling Objectives

-

Resource Infill and Expansion Drilling:

- Infill and Step-out Drilling at Pilar Main Zone where 2022 core drilling returned:

- 116.9-meters of 1.2 g/t Au and 7 g/t Ag in drillhole JES-22-59

- 108.6-meters of 0.8 g/t Au and 3 g/t Ag in drillhole JES-22-62

- Expansion Drilling to the Southeast where past step-out drilling returned:

- 39.7-meters of 1.0 g/t Au and 2 g/t Ag in drillhole JES-21-50

- 13.7-meters of 0.6 g/t Au and 13 g/t Ag in drillhole JES-22-63

- Expansion Drilling to the north where past drilling returned:

- 29.0-meters of 0.7 g/t Au and 2 g/t Ag in drillhole JES-21-38

- 21.0-meters of 38.3 g/t Au and 38 g/t Ag in historic drillhole S-10

- Expansion Drilling along the 4-T Trend where past drilling returned:

- 15.3-meters of 1.1 g/t Au and 2 g/t Ag in drillhole JES-21-53

- 30.5-meters of 0.4 g/t Au in step out drillhole JES-22-67

- Infill and Step-out Drilling at Pilar Main Zone where 2022 core drilling returned:

-

Evaluation of New Discoveries and Targets:

- Pilar Extension North and Northeast:

- Surface sampling returned 3.5 g/t Au and 645 g/t Ag

- Placer Mining Corridors

- New 3-kilometer corridor with multiple target zones

- New Surface Discovery, 2-meters of 5.6 g/t Au and 106 g/t Ag

- Pilar Extension North and Northeast:

LiDAR Update

In addition, the LiDAR survey across the entire Pilar area has been completed, final data processing is currently underway with four of six flight sections processed to date. The LiDAR survey will serve as a detailed 3D surface across the greater Pilar property and be utilized for project and development planning.

About the Pilar Property

The Pilar Gold-Silver property has recently returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Three primary zones of mineralization have been identified in the north-west part of the property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. The Main Zone and 4-T trends are open to the southeast and new parallel zones have been recently discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. To date, over 23,000 m of drilling has been completed.

Pilar Drill Highlights:

-

2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

- 116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

- 108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

- 63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

-

2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

- 39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

- 47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

- 29m @ 0.7 g/t Au

- 35.1m @ 0.7 g/t Au

-

2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

- 94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

- 41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

- 24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

-

15,000m of Historic Core & RC drilling. Highlights include:

- 21.0m @ 38.3 g/t Au and 38 g/t Ag

- 13.0m @ 9.6 g/t Au

- 9.0m @ 10.2 g/t Au and 46 g/t Ag

- 61.0m @ 0.8 g/t Au

Pilar Bulk Sample Summary:

- 62% Recovery of Gold Achieved Over 46-day Leaching Period

- Head Grade Calculated at 1.9 g/t Au and 7 g/t Ag; Extracted Grade Calculated at 1.2 g/t Au and 3 g/t Ag

- Bulk Sample Only Included Coarse Fraction of Material (+3/4" to +1/8")

- Fine Fraction (-1/8") Indicates Rapid Recovery with Agitated Leach

- Agitated Bottle Roll Test Returned Rapid and High Recovery Results: 80% Recovery of Gold and 94% Recovery of Silver after Rapid 24-hour Retention Time

Additional Metallurgical Studies:

- Gravity Recovery with Agitated Leach Results of Five Composite Samples Returned

- 95 to 99% Recovery of Gold

- 73 to 97% Recovery of Silver

- Includes the Recovery of 99% Au and 73% Ag from Drill Core Composite at 120-meter depth.

About Tocvan Ventures Corp.

Tocvan Ventures Overview Video

Tocvan is a well-structured exploration development company. Tocvan was created in order to take advantage of the prolonged downturn in the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan has approximately 43 million shares outstanding and is earning 100% into two exciting opportunities in Sonora, Mexico: the Pilar Gold-Silver project and the Picacho Gold-Silver project. Management feels both projects represent tremendous opportunity to create shareholder value.

Quality Assurance / Quality Control

Samples were shipped for sample preparation to ALS Limited in Hermosillo, Sonora, Mexico and for analysis at the ALS laboratory in North Vancouver. The ALS Hermosillo and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Gold was analyzed using 50-gram nominal weight fire assay with atomic absorption spectroscopy finish. Over limits for gold (>10 g/t), were analyzed using fire assay with a gravimetric finish. Silver and other elements were analyzed using a four-acid digestion with an ICP finish. Over limit analyses for silver (>100 g/t) were re-assayed using an ore-grade four-acid digestion with ICP-AES finish. Control samples comprising certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's robust quality assurance / quality control protocol.

Brodie A. Sutherland, CEO for Tocvan Ventures Corp. and a qualified person ("QP") as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Cautionary Statement Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor its regulation services provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company's business, the Company's formative stage of development and the Company's financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

820-1130 West Pender St.

Vancouver, BC V6E 4A4

403-829-9877

bsutherland@tocvan.ca

The Howard Group

Jeff Walker

VP Howard Group Inc.

403-221-0915

jeff@howardgroupinc.com

SOURCE: Tocvan Ventures Corp

View the original press release on accesswire.com