VANCOUVER, BC / ACCESSWIRE / August 30, 2022 / Snipp Interactive Inc. ("Snipp" or the "Company") (TSX-V:SPN; OTCPK:SNIPF), a global provider of digital marketing promotions, rebates and loyalty solutions, announces its financial results for Q2 2022. All results are reported under International Financial Reporting Standards ("IFRS") and in US dollars. A copy of the complete unaudited interim financial statements and management's discussion and analysis are available on SEDAR (www.sedar.com).

Q2 2022 Highlights

(Refer to Non-GAAP Measures, Gross Margin, EBITDA and Bookings Backlog discussion below)

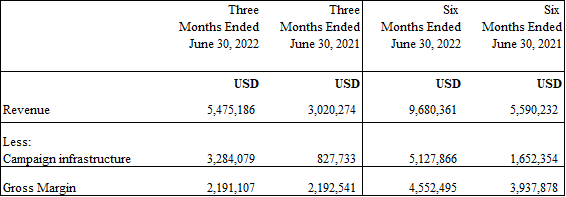

- Revenue for Q2 2022 increased by 81% compared to Q2 2021. Revenue for Q2 2022 was $5,475,186 compared to $3,020,274 for Q2 2021.

- In Q2, the Company re-launched the Gambit Rewards platform, which it acquired in February, 2022. Gambit sales accounted for 14% of total Q2 revenue.

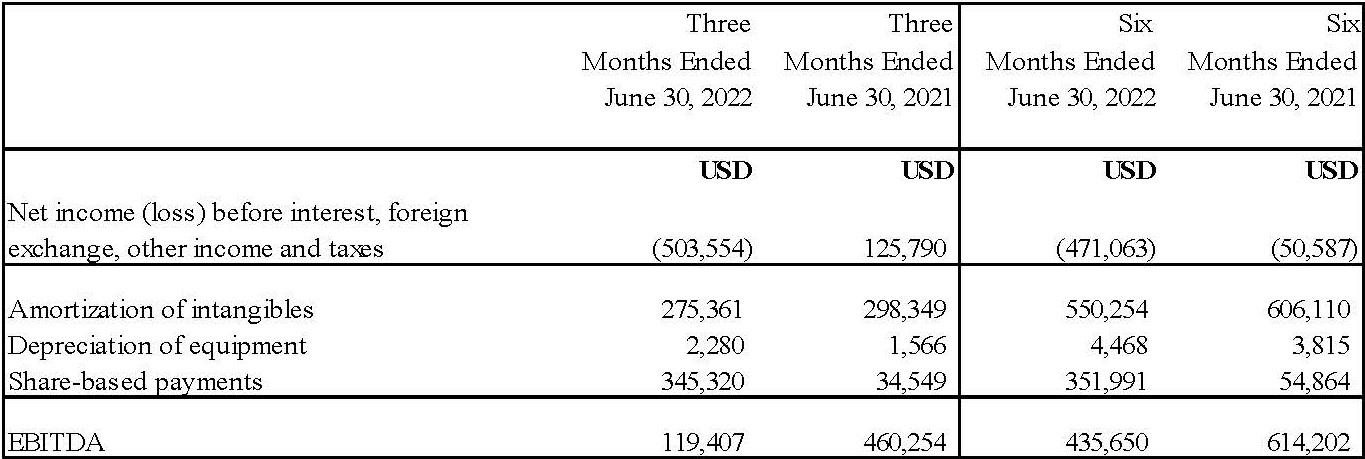

- EBITDA in Q2 2022 was $119,407 vs Q2 2021 EBITDA of $460,254.

- The Company has generated positive EBITDA for the last ten consecutive quarters.

- Gross margin in Q2 2022 was 40% compared to 73% in Q2 2021.

- Margin decline is largely attributable to the re-launch of the Gambit Rewards program. Gross Margins are likely to remain pressured while the Company continues to invest in the roll out of Gambit in order to build a monetizable audience.

- Revenue for the six months ended June 30, 2022 increased by 73% compared to the six months ended June 30, 2021. Revenue for the six months ended June 30, 2022 was $9,680,361 compared to revenue for the six months ended June 30, 2021 of $5,590,232.

- EBITDA in the six months ended June 30, 2022 was $435,650 compared to $614,202 for the six months ended June 30, 2021.

- Gross margin for the six months ended June 30, 2022 was 47% compared to 70% for the six months ended June 30, 2021.

- Bookings Backlog (programs that have been sold, but whose revenues have not yet been recognized) stood at $11MM at June 30, 2022, an increase of 16% compared to June 30, 2021 of $9.5MM.

"The second quarter of 2022 was a transformational period for the company with revenue increasing 81%. We also recorded our tenth consecutive quarter of positive EBITDA. As we begin the third quarter, we are enthusiastic about the drivers of growth impacting our business today. The strategic partnership and investment from Bally's provides an exciting opportunity for our business to scale in the years to come. Their $5 million investment has also bolstered our balance sheet. The Company ended the quarter debt free, with approximately $7 million in cash. Over the period our core business increased 55% during the quarter. Growth was driven by our continued focus on our strategy of expanding into new verticals, expanding into new geographies, and focusing on expanding our share of wallet with our existing Fortune 500 clients. Moving on to Gambit, which we acquired earlier this year. Gambit is the first of its kind to compete in a market that we estimate is worth $100Bn in unused loyalty points. Gambit is already contributing to revenue following the successful launch of our first client at the beginning of the second quarter. User acquisition is key in the early stages of a B2C consumer business and typically is the highest cost for new consumer-based applications. The Gambit revenue model will provide leverage to our operating business as it scales. We are currently testing profitable customer acquisition models by reinvesting the margin generated from our existing users into new user growth. This dynamic within the Gambit business model will move us closer to our goal of building a monetizable audience that can be leveraged in multiple ways by the core Snipp Interactive business over time. The second quarter set this initiative into motion. While our blended gross margin profile has declined temporarily, we expect profitable growth to continue and margins to move back towards our historical range as Gambit scales its customer base. We are confident that Gambit can grow rapidly in the quarters ahead and look forward to sharing updates on our initiatives and partners as they come to fruition." said Atul Sabharwal, Founder of Snipp.

Non-GAAP Measures

Snipp uses certain performance measures throughout this document that are not recognizable under Canadian generally accepted accounting principles or IFRS ("GAAP"). These performance measures include Gross Margin and EBITDA. Management believes that these measures provide supplemental financial information that is useful in the evaluation of the Company's operations.

Investors should be cautioned, however, that these measures should not be construed as alternatives to measures determined in accordance with GAAP and IFRS as an indicator of Snipp's performance. The Company's method of calculating these measures may differ from that of other organizations, and accordingly, these may not be comparable.

EBITDA

Snipp defines earnings before interest, taxes, depreciation and amortization ("EBITDA") as revenue minus operating expenses excluding non-cash operating expenses of share-based payments, depreciation and amortization (interest and taxes are not included in the Company's operating expenses).

Gross Margin

Snipp defines Gross Margin as revenue less campaign infrastructure. The Company's calculation of Gross Margin is not a financial measure that is recognized under GAAP. Investors should be cautioned that the Company's defined Gross Margin should not be construed as an alternative measure to other measures determined in accordance with GAAP.

Bookings Backlog

Snipp defines Bookings Backlog as future revenue from existing customer contracts to be recognized in future quarters. Bookings get translated into revenues based on IFRS principles and the Bookings Backlog reflects how revenues in future quarters are steadily being booked today.

The Following are calculations of EBITDA:

The Following are calculations of Gross Margin:

About Snipp:

Snipp Interactive Inc (TSX-V: SPN; OTCPK: SNIPF) is a leading Platform-as-a-Service (PaaS) company in the global loyalty and promotions sector. Snipp's proprietary and modular SnippCARE (Customer Acquisition, Retention & Engagement) Platform allows its marquee list of Fortune 500 clients and world-class agencies and partners to use various modules of the Platform to run long-term and short-term programs and promotions, while continually generating and capturing unique zero party data that is invaluable in providing insights to drive sales. SnippCHECK, the Platform's Receipt Processing Module has established itself as the clear industry leader and standard by powering a large majority of all receipt-based promotions in North America. SnippLOYALTY, the Platform's full scale modular loyalty engine allows clients the flexibility of deploying any/all aspects of a standard loyalty program on a case-by-case basis. SnippREWARDS, the Platform's modular catalogue of digital and physical rewards provides clients with global and easily deployable access to an extensive catalogue of digital and physical rewards. SnippWIN, the Platform's gaming module solves for the implementation and compliance difficulties of offering games of chance and skill on a global basis and allows for the global deployment and administration of legally compliant games of chance and skill. For more information, visit Snipp's website at www.snipp.com.

Snipp is headquartered in Vancouver, Canada with a presence across the United States, Canada, Ireland, Europe, and India. Snipp is publicly listed on the TSXV in Canada and is also quoted on the OTC Pink marketplace under the symbol SNIPF.

FOR FURTHER INFORMATION PLEASE CONTACT:

Snipp Interactive Inc.

Jaisun Garcha

Chief Financial Officer

investors@snipp.com

1-888-99-SNIPP

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that involve risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to such risks and uncertainties. Many factors could cause our actual results to differ materially from the statements made, including those factors discussed in filings made by us with the Canadian securities regulatory authorities. Should one or more of these risks and uncertainties, such as changes in demand for and prices for the products of the company or the materials required to produce those products, labour relations problems, currency and interest rate fluctuations, increased competition and general economic and market factors, occur or should assumptions underlying the forward looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, or expected. We do not intend and do not assume any obligation to update these forward-looking statements, except as required by law. The reader is cautioned not to put undue reliance on such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright Snipp Interactive Inc. All rights reserved. All other trademarks and trade names are the property of their respective owners.

SOURCE: Snipp Interactive Inc.

View source version on accesswire.com:

https://www.accesswire.com/713969/SNIPP-INTERACTIVE-REPORTS-81-REVENUE-GROWTH-FOR-Q2-2022-Tenth-Consecutive-Quarter-of-EBITDA-Profitability-Debt-Free-Balance-Sheet-with-7000000-Cash-Position